The WiseTech Global Ltd (ASX: WTC) share price has hit another all-time high today as the company continues to expand its global operations.

WTC share price

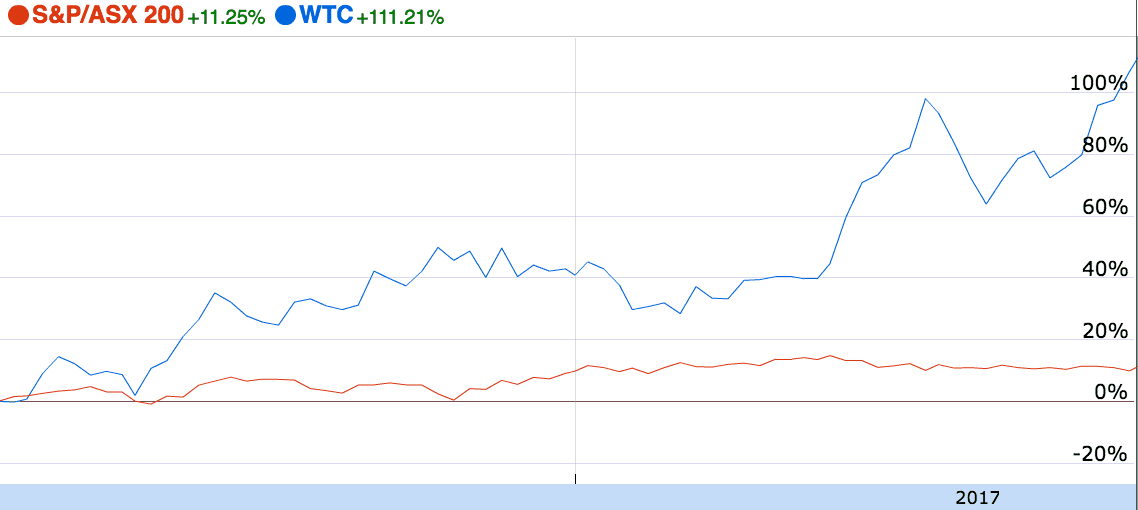

As can be seen in the chart above, WiseTech shares have been gathering significant pace in recent months. Compared to the market, or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO), which is up 1.3% this year — WiseTech shares are trading 50% higher.

Fuelled by the organic growth of its logistics software, CargoWise One, and smaller acquisitions, the company continues to move from strength to strength. Just today, the company announced that it would acquire Dutch business Cargoguide and the US-based CargoSphere."

Although the acquisitions are not material for WiseTech they reinforce the company's strategy of becoming a global powerhouse in logistics software.

"Along with our recent acquisitions in Brazil, Taiwan and Australasia, these two global adjacency transactions are in line with our stated strategy of accelerating long-term organic growth through small, targeted, valuable acquisitions across new geographies and adjacencies," WiseTech wrote in its ASX announcement.

Is it time to buy WiseTech shares?

At today's prices, WiseTech shares change hands at an eye-watering 78 times last year's profit. Looking further afield, however, analysts continue to expect strong growth from WiseTech, operationally and financially as consumers and businesses send and receive more goods more often.

Therefore, some investors might see value in buying WiseTech shares for the long-term at today's prices. However, personally, I would rather wait for the valuation to become more compelling before buying shares for my portfolio.