I'll admit it: I'm not actually sorry. That was just for effect and a catchy headline.

Apple (Nasdaq: AAPL) bears have been running amok for the past couple of weeks, with shares trading as low as US$555 yesterday before earnings — US$89 below the US$644 all-time high reached recently. Who granted them the freedom to gallivant unsupervised? Thankfully, Apple's second-quarter results are sending them on their way.

Back to back

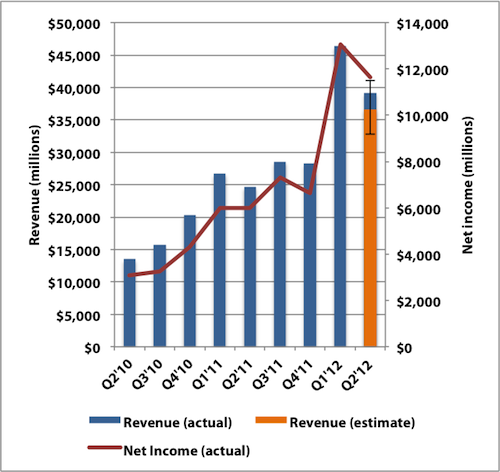

Following up a first-quarter blowout, we have another blowout on our hands. Revenue jumped 59% to US$39.2 billion, while net income soared 94% to US$11.6 billion, or US$12.30 per share. Compare those to Street estimates of US$36.6 billion in sales and US$10 per share in profit, and bid the bears farewell.

The Mac maker now has US$110.2 billion in cash and investments on the books, but don't worry, it'll start giving some of that back to shareholders starting in the fourth fiscal quarter. Apple sold more than 4 million Macs, growing 7% and outpacing the broader PC market for the 24th consecutive quarter.

USA: No longer the land of opportunity (at least not for the iPhone)

Much of the recent pessimism has been centered on iPhone activation figures coming out of domestic carrier partners AT&T (NYSE: T) and Verizon (NYSE: VZ) . Both reported sequential drops in activations that sceptics thought spelled trouble for Apple, if their iPhone shares remained relatively stable. Unsurprisingly, this proved to be a bogus assumption.

|

Carrier |

Q4 2011 (activations) |

Q4 2011 (% of total) |

Q1 2012 (activations) |

Q1 2012 (% of total) |

|---|---|---|---|---|

| AT&T | 7.6 million | 20.5% | 4.3 million | 12.3% |

| Verizon | 4.3 million | 11.6% | 3.2 million | 9.1% |

| Sprint | 1.8 million | 4.9% | 1.5 million | 4.3% |

| Domestic total | 13.7 million | 37.0% | 9 million | 25.7% |

| International total | 23.3 million | 63.0% | 26.1 million | 74.3% |

Source: Earnings press releases and conference calls. Calendar quarters shown.

Adding Sprint Nextel's (NYSE: S) Q4 activations of 1.8 million means that 63% of Apple's calendar-fourth-quarter iPhone sales came from outside the US. Sprint just reported this quarter's iPhone activations, and they actually declined sequentially less than its larger rivals. International iPhone sales comprised 74.3% of unit sales. Echoing this theme, 64% of total revenue this quarter was international sales.

Apple ended up selling a mind-boggling 35.06 million iPhones, easily trouncing the 30 million estimate. The iPhone average selling price, or ASP, ticked down to US$647, compared to US$659 last quarter and US$660 a year ago.

We need more iPads posthaste!

iPad unit sales actually came in a hair shy of expectations, but the iPhone beat more than compensated for the shortfall. Apple sold 11.8 million iPads, a 151% increase, compared to the 12 million that investors were looking for.

iPad ASP dropped more meaningfully than iPhone ASP, from US$604 a year ago to US$559 this quarter. This was expected as the entry-level price fell to US$399 for the base iPad 2 model. CEO Tim Cook conceded that the new iPads continue to face supply constraints, although they're not nearly as bad as the shortages that held back Cupertino last year with the iPad 2 launch.

The latest generation was launched with only a few weeks left in the fiscal quarter. Apple continues to "sell them as fast as [it] can make them." Even now, domestic shipping times for new models span five to seven business days.

No MacBookPads?

Some of Apple's rivals have been exploring hybrid devices, like tablet/laptops, or smartphone/tablet/laptops, and others. Cook shot down the idea of Apple pursuing this type of functionality, saying it would require trade-offs that the company isn't willing to make.

In characteristic dry humor, Cook said, "You can converge a toaster and refrigerator, but those things are probably not going to be pleasing to the user." Don't hold your breath for any MacBookPads.

Settling with Cook

Cook also provided further evidence that the iOS and Google (Nasdaq: GOOG) Android patent wars may be winding down. He said:

I've always hated litigation and I continue to hate it. We just want people to invent their own stuff. If we could get to some kind of arrangement where we could be assured that's the case and a fair settlement on the stuff that's occurred, I would highly prefer to settle versus battle. But the key thing is that, it's very important that Apple not become the developer for the world.

That's direct confirmation that Cook's stance differs dramatically from his predecessor's.

You can't spell Apple in China without China

Surprise, surprise. China put up major growth. Greater China chalked up US$7.9 billion in revenue, up more than three times relative to a year ago. For the first half of this fiscal year, Apple has garnered US$12.4 billion in sales in the region, compared to the US$13.3 billion it saw in all of last year.

Cook cited pent-up iPhone 4S demand as a contributor, although the new iPad still isn't shipping yet in Mainland China (it is shipping in Hong Kong, though). Mac growth within China soared 60%, which is helping to drive the 29% Mac growth that Apple saw in its broader Asia Pacific segment. It's a good thing, too, as Mac sales in the Americas are flat.

Time to hibernate for the summer

Once again, Cupertino proves the bears wrong. A little bit of profit taking is expected considering Apple's incredible rally year-to-date, but the iPhone scepticism was clearly misplaced.

We're not entirely surprised that the iPad came in a tad light, as recently we wrote, "If a large number of would-be iPad buyers were delaying purchases in anticipation of the new model and weren't able to get their hands on one due to shortages, then Apple could potentially come up short with iPad sales."

All things considered, this was a monster quarter. Again.

With international sales comprising 64% of revenue, Apple is clearly an American company set to dominate the world.

The ASX is already on the move in 2012, and Goldman Sachs experts recently said they reckon S&P/ASX 200 could top 5,000 next year. Read This Before The Coming Market Rally is a must-read for investors who don't want to miss out on the party. Click here now to request your free copy, before it's too late

More reading

- Shopping for loyalty… and information

- Seven West Media: Shares fall by 17%

- 4 ASX stocks that jumped over 10 per cent last week

Take Stock is The Motley Fool Australia's free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Click here now to request your free subscription, whilst it's still available. This article contains general investment advice only (under AFSL 400691).