The Rural Funds Group (ASX: RFF) share price is down more than 1% after the S&P/ASX 300 Index (ASX: XKO) share went ex-distribution.

This comes at a time when the ASX 300 is currently up 0.1%.

Ex-distribution date

Rural Funds pays a distribution every three months and the latest payment will soon be allocated to investors.

The ex-distribution date tells us when new investors miss out on the payment – there has to be a cut-off point for the upcoming payment.

For Rural Funds, today (27 March 2024) is the ex-distribution date. Anyone buying Rural Funds shares won't receive the upcoming distribution of 2.93 cents per unit. So, investors aren't getting as much short-term value today as yesterday.

At yesterday's Rural Funds share price, the upcoming quarterly payment translates into a distribution yield of 1.4%.

When is the Rural Funds distribution being paid?

Rural Funds is planning to pay this quarterly distribution on 30 April 2024.

If investors want to receive more Rural Funds units rather than cash, they can take part in the distribution reinvestment plan (DRP). The DRP election date is Tuesday 2 April 2024, with 5 pm being the cut-off time.

What is the FY24 distribution yield?

In the recent FY24 first-half result, Rural Funds confirmed it's planning to pay an annual distribution of 11.73 cents per unit, which is a current distribution yield of 5.7%.

This is mostly being paid for by an expected adjusted funds from operations (AFFO) – which is essentially net rental profit – of 11.2 cents per unit.

The business is investing in some farms, and converting a few to macadamia farms, which will hopefully lead to improved rental income.

Rural Funds share price snapshot

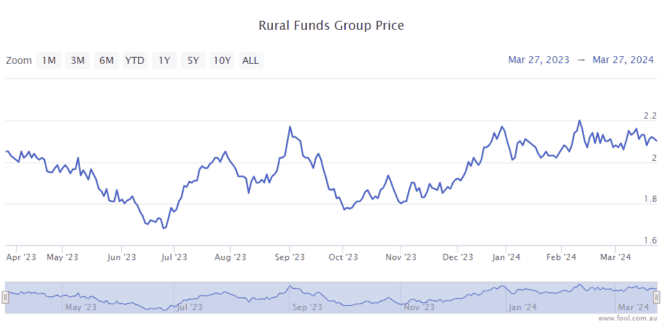

Despite everything that has happened over the past 12 months, the Rural Funds share price is virtually where it was a year ago.