Fancy earning a 41% yield from a quality S&P/ASX 200 Index (ASX: XJO) dividend stock?

Me too!

Now, no ASX 200 dividend stocks on my screen come close to paying that kind of passive income today. But buying quality income stocks at depressed prices could see you earning some seriously outsized yields like this down the road.

Which is how some savvy investors are earning a fully franked yield of 40.9% from ASX 200 coal share New Hope Corp Ltd (ASX: NHC).

New Hope reported its half-year results on Tuesday.

With coal prices coming off the boil, the miner's after tax profits plunged 62.4% year on year to $251.7 million.

As you'd expect, this saw management slash New Hope's interim dividend by 57% to 17 cents per share. If you'd like to bag that passive income payout, you'll need to own shares at market close on Friday 12 April. New Hope trades ex-dividend on 15 April.

Atop the interim payout, New Hope also delivered a final dividend of 30 cents per share, paid on 7 November.

That brings the full-year payout to 47 cents per share.

At the current New Hope share price of $4.53, the ASX 200 dividend stock trades on a fully franked yield (partly trailing, partly pending) of 10.4%.

Here's how some savvy investors are earning four times as much from their shares.

A turbocharged yield from this ASX 200 dividend stock

"Be greedy when others are fearful," counsels billionaire investing guru Warren Buffett.

Of course, that doesn't mean buying any fast-falling ASX 200 dividend stock. And trying to time the market to buy stocks at or near their lows can be a perilous venture.

But there are times when quality companies are beaten down by outside temporary headwinds beyond their control. And investors who can spot those opportunities and swallow their fears when fears consume the majority of the market can enjoy some outsized rewards over time.

Like investors who bought New Hope shares in the wake of the 2020 pandemic market collapse.

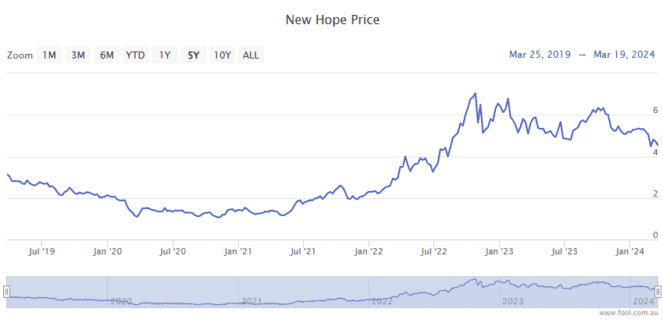

Cratering energy prices saw shares in the ASX 200 dividend stock crash by 39% from the start of 2020 through to 20 March, when New Hope closed trading for $1.15 a share.

Investors who bought on the day will be earning the same 47 cents per share in dividends as investors who bought at current levels.

Meaning these savvy investors are earning a massive fully franked yield of 40.9% on those shares.

As always, whether you're looking at buying New Hope shares or another high-yielding ASX 200 dividend stock, be sure to do your own thorough research first. If you're short on time or don't feel comfortable with that, simply reach out for some expert advice.