Cheaper homes and ASX small-cap shares are delivering superior capital growth to investors in 2024, new figures show.

ASX small-cap shares are defined as companies with a market capitalisation of between a few hundred thousand and $2 billion.

Cheaper homes are defined by CoreLogic as the bottom 25% of homes by price in any market.

Shares vs. property: What are the changing trends?

Fund manager Allan Gray said investors abandoned ASX small-caps last year. They went for the perceived safety of ASX large-caps instead amid a volatile share market created by difficult macroeconomics.

But the tide may have turned.

Investors appear to have more appetite for risk in 2024. This is due to expectations of interest rates coming down and the battle against inflation easing, say the experts.

Under the right circumstances, investors like small-caps because they are typically younger companies offering better prospects for growth than the ASX 200 blue chips.

Morgans analysts say ASX small-caps have historically bounced hardest when it's clear the rates cycle is flattening out. Yesterday, the Reserve Bank held interest rates steady for a third consecutive month.

The broker said:

We think the tide is turning for small-caps, and now is an opportune time to build exposure to forgotten small-caps.

In the year to date, the S&P/ASX Small Ordinaries Index (ASX: XSO) has risen 3.2%, while the S&P/ASX 200 Index (ASX: XJO) has lifted 0.77% and the S&P/ASX All Ordinaries Index (ASX: XAO) has risen 0.91%.

What about shares vs. property?

Now to property…

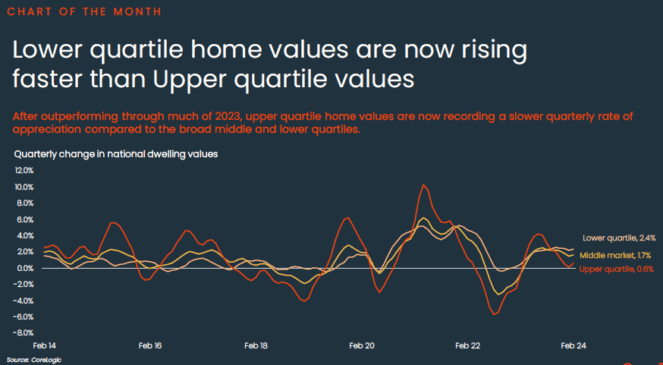

In terms of property, cheaper homes are now growing in value faster than premium homes, according to new CoreLogic figures.

CoreLogic research director Tim Lawless said the lower price quartile of every capital city market booked a higher rate of growth than the upper quartile over the past three months ending 29 February.

Lower quartile homes (bottom 25% of homes by price) rose in value by 2.4%.

Middle quartile residences (middle 50% of market) grew 1.7%.

Upper quartile properties (top 25% of market) rose by 0.6%.

Source: CoreLogic

Lawless said this is a reversal of trends.

He explained that the upper price quartile typically leads every new market cycle, whether it be an upswing or downswing. That happened in early 2023 as the market rebounded from the 2022 slump.

But in the second half of 2023, the trend reversed and cheaper homes began rising faster in value.

Which ASX small-caps are favourites?

Morgans' favourite seven small-caps include ASX biotech Clinuvel Pharmaceuticals Limited (ASX: CUV) and debt collector Credit Corp Group Limited (ASX: CCP).

IML analysts are backing Kelsian Group Ltd (ASX: KLS), Australian Clinical Labs Ltd (ASX: ACL), and SG Fleet Group Ltd (ASX: SGF).

Among the top movers of the Small Ords Index in 2024 so far are DroneShield Ltd (ASX: DRO) up 81%, Step One Clothing Ltd (ASX: STP) up 71.5%, and Bravura Solutions Ltd (ASX: BVS) up 69%.

In terms of shares vs. property, no one can argue this trio of shares is shooting the lights out!

Where are people buying cheaper homes?

Everywhere.

The fact that the lower quartile of every capital city market had the strongest rate of growth over the past three months reflects buyers' search for affordability amid high interest rates and cost of living pressures.

Buyers are seeking value not just because home prices keep rising, but also because high interest rates mean they are limited as to how much finance they can get to fund the purchase of their next home.

In these situations, we often see buyers in capital cities comprising on location by checking out the suburbs next door to where they would ideally love to live. These suburbs are sometimes referred to as the 'poor cousins' of the more desirable and expensive suburbs of an area.

It's also worth noting that property investors are no longer sticking to the areas they know and live in. They're increasingly scouring the country, looking for homes that suit their borrowing capacities better.

Where are investors buying cheaper investment property?

Perth is one of the hottest markets in the country with property investors today.

Here's the pitch to prospective investors:

- Perth is cheaper to buy in, with a median house price of $718,560 vs. $1,395,804 in Sydney, $942,779 in Melbourne, and $899,474 in Brisbane

- Perth offers today's best capital growth rate (5.2% over three months and 18.3% over 12 months)

- Perth offers the second-best rental returns of all the cities at 4.4% for houses and 6.2% for apartments

I rest my case for investment.

Over the past three months, Perth's lower quartile market recorded the strongest growth of all the lower quartile capital city markets.

Investors typically target lower quartile properties because they are more affordable and provide stronger yields.

And right now, East Coast investors cannot buy investment properties fast enough out west.

This is adding more demand to the Perth market, which has not attracted this much interstate interest in years.

Real Estate Institute of Western Australia President Joe White said:

… WA and Perth have caught the eye of Eastern States investors. They're drawn by the value our market offers. Despite increases over the past few years, our property prices are much more affordable than the east coast and we've had significant rent price growth. This means properties have the potential for very good yields.

ASX small-cap shares vs. property over the past three months

Just to recap, let's put our two asset classes head to head amid these changing trends…

The S&P/ASX Small Ordinaries Index (ASX: XSO) has risen 3.2% in the year to date.

This compares to Australia's lower quartile property market rising 2.4% over the three months ending 29 February, partly due to more investors buying investment property in cheaper locations.

The middle market rose 1.7% and the upper quartile rose 0.6% over the three-month period.