It's another busy week ahead for ASX shares.

Here is eToro market analyst Josh Gilbert's take on the three biggest developments that investors should be looking out for:

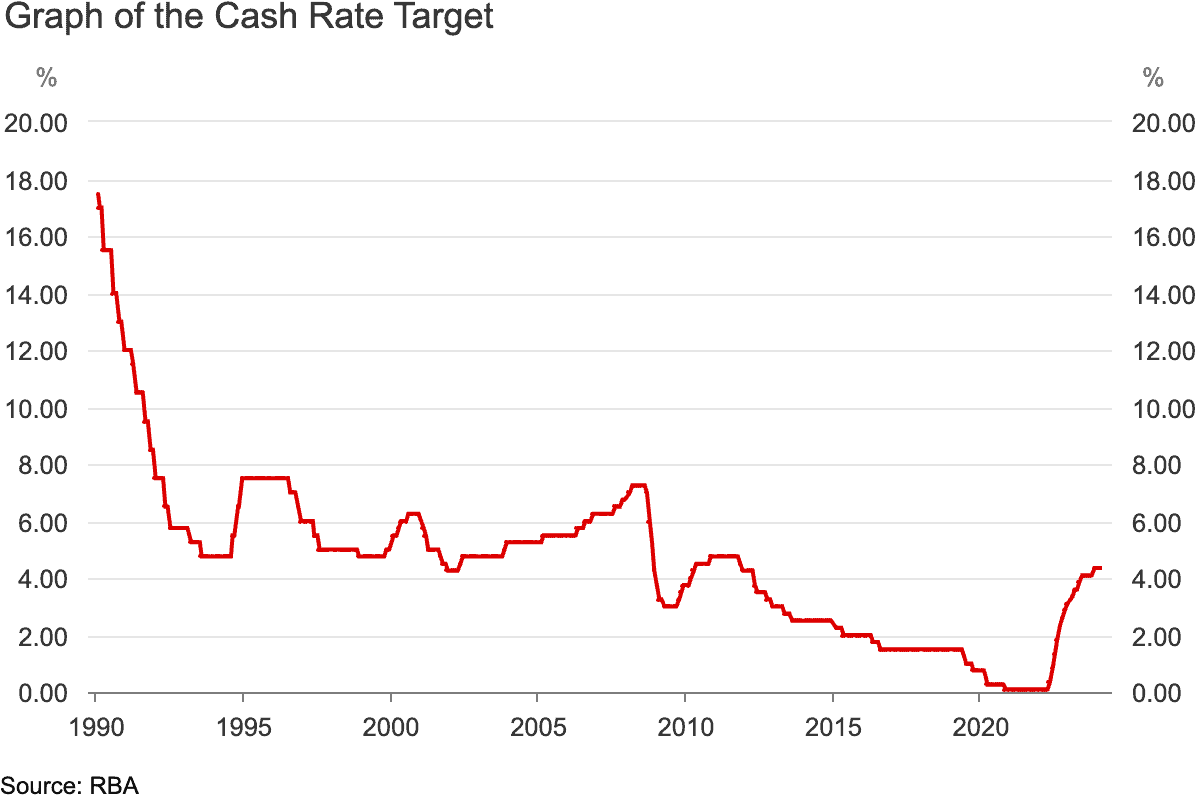

1. RBA interest rate decision

Here we go again.

Mortgage holders, businesses and investors alike will all be on high alert 2:30pm Tuesday to see what the Reserve Bank of Australia will do with interest rates.

Gilbert's thinking another hold is likely.

"The data that the RBA has received this year, especially inflation data at the end of February, has reinforced that the board is done hiking.

"However, there may not be enough evidence just yet for Michele Bullock to pivot to an easing bias."

There's no doubt consumers are struggling from the cost of living, but the RBA's priority is to tame inflation, as that will cause longer term damage.

"Markets still see June as the first meeting when the RBA is likely to cut interest rates for the first time in 2024," said Gilbert.

"This meeting will be the last meeting until May, and before then, the RBA will receive a wealth of data, including February and March monthly inflation indicators, as well as the all-important Q1 figure."

2. US interest rate decision

The RBA's American counterpart, the US Federal Reserve, will also make a call on their rates this week.

Inflation is proving stubborn across the Pacific too, but Gilbert said financial markets are still pricing in a rate cut in June.

"That's because the [latest] reading showed good news on services inflation — an area of inflation Jerome Powell has fretted over in recent times."

The big worry for stock investors is that the Fed will adopt a "higher for longer" stance.

"Given that rates are highly likely to stay on hold next week, the focus shifts to Jerome Powell's comments, and I wouldn't be surprised to see some pushback, which could put the US stock rally on ice."

Gilbert added that the central bank would also update its growth projections this week, which includes metrics like "gross domestic product growth, unemployment, interest rates and inflation".

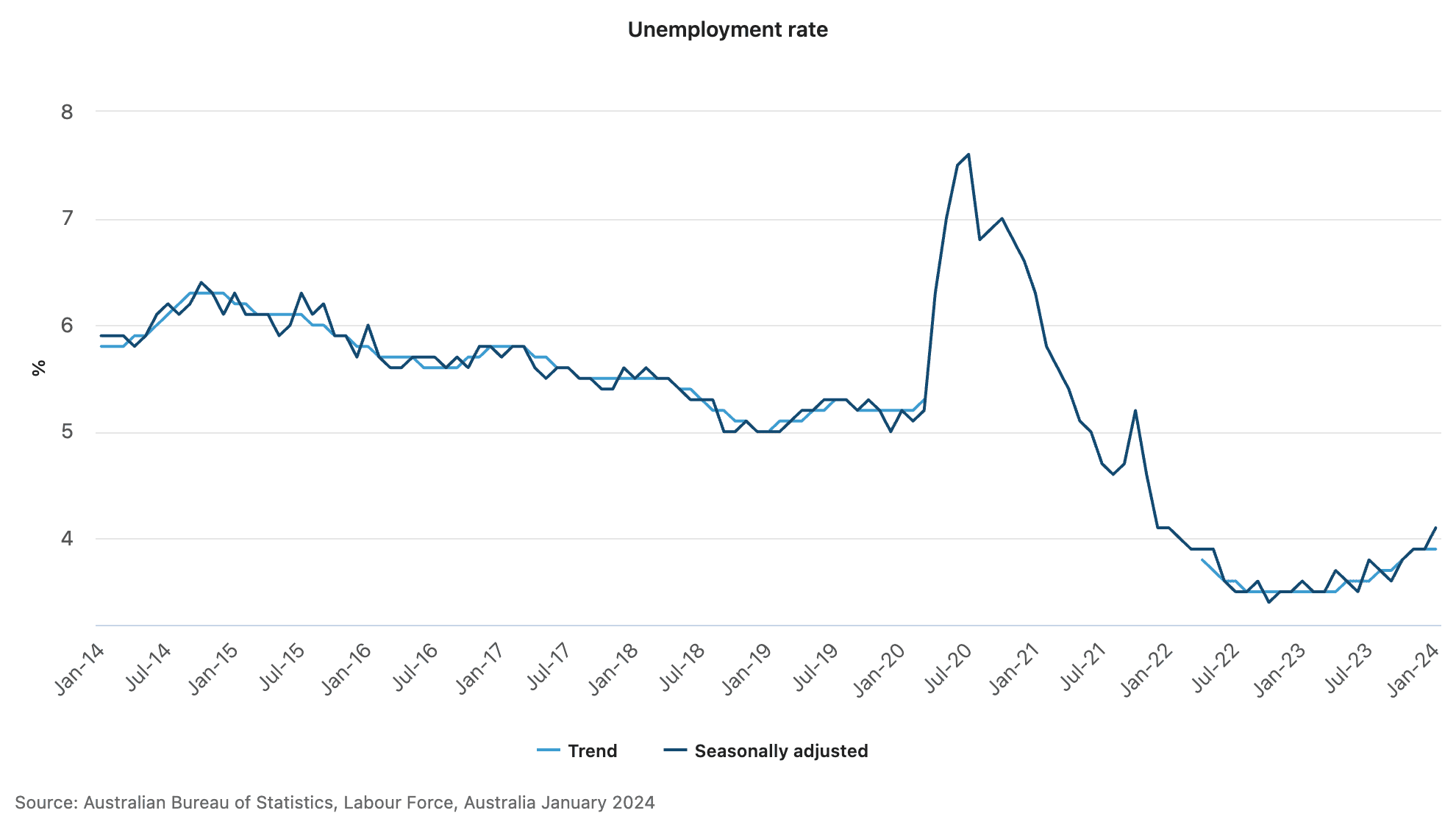

3. Australia unemployment

The latest jobless numbers are due out on Thursday, which follows a two-year high of 4.1% last month.

"Demand for workers is falling, with Australia's ANZ-Indeed job advertisements report showing ads were down 12.4% year-over-year in February and down 2.8% from January 2024."

Gilbert reckons the unemployment rate will stay the same this time, but could grow to 4.3% by the last quarter of this year.

It's all a delicate balancing act for the Reserve Bank.

"The growing unemployment rate remains one of the key drivers for the RBA to cut rates in the middle of the year.

"However, a jump in employment outside of the RBA's projection of 4.3% may be a slight worry for the RBA and would be a huge dent in consumer confidence if it continues to move at the same speed."