Many Australians believe passive income is a privilege that only wealthy people have access to.

But in reality it's not.

Buying just a handful of ASX shares could start your own experience of receiving money in return for no work.

Check out this hypothetical:

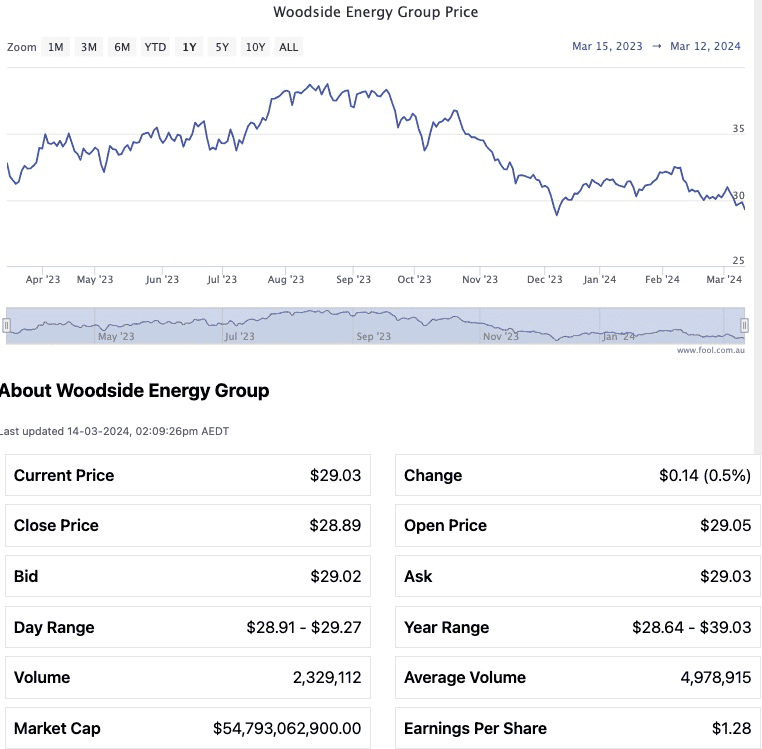

Here's what Woodside shares could provide you

Woodside Energy Group Ltd (ASX: WDS) is an Australian oil and gas producer.

Yes, the world is quite rightly trying to move away from fossil fuels. But the infrastructure necessary to generate enough power from renewable energy sources to completely take over is many years, or even decades, away.

In the meantime, a fast-growing middle class population in countries like India, China and Brazil are demanding living standards that those of us fortunate enough to be in the West have enjoyed for decades.

All this requires energy.

Up until a few months ago, the Woodside dividend yield was incredibly up in double digits. The coming April dividend has brought it down to a more sane 7.5%.

So if you have an empty portfolio and as the first move you buy 350 Woodside shares, you will have spent just a touch over $10,000.

If the company can maintain the current yield, by the end of the first year you will have pocketed about $760.

That's your first passive income!

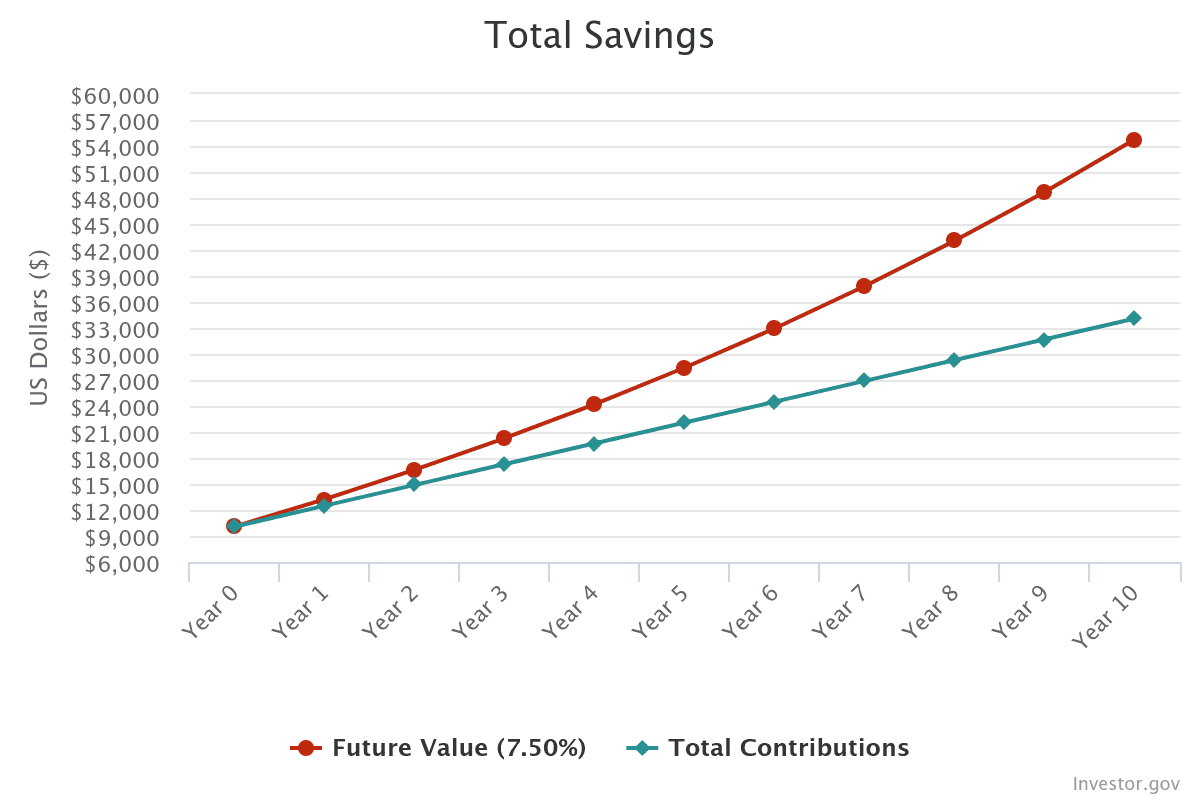

Patience = even larger passive income

What if you want a bigger flow of income?

Then, keep reinvesting those dividends, continue saving, and let the portfolio grow for a few years.

After 10 years of adding $200 monthly and compounding at 7.5% each year, your Woodside shares could be worth a tidy $54,769.

That means that from the 11th year, you could cash in an average of more than $4,100 of annual passive income.

That could buy you a nice holiday for your family each year that is effectively free.