If it's passive income you're after, you may wish to run your slide rule over Rio Tinto Ltd (ASX: RIO) shares.

The S&P/ASX 200 Index (ASX: XJO) mining stock has a long track record of paying two fully franked dividends a year.

Rio Tinto reported its full year results on 21 February.

A highlight for passive income investors was the fully franked final dividend of $3.93 a share (converted from US dollars). In Aussie dollar figures that's up 20% from the prior year's final dividend.

If you owned Rio Tinto shares at market close on 6 March, those dividends should hit your bank account on 18 April. Rio Tinto traded ex-dividend last Thursday.

The boosted final dividend was delivered despite a 3% year on year decline in revenue to US$54.04 billion. Underlying EBITDA was down 9% from 2022 to US$23.89 billion

Atop the final dividend, Rio Tinto also paid a fully franked interim dividend of $2.61 on 21 September.

That works out to a full-year payout of $6.54 a share.

At the current share price of $116.65, Rio Tinto shares trade on a fully franked trailing yield of 5.6%.

Here's how these passive income investors are earning much more.

Buying Rio Tinto shares when the market is fearful

As legendary investor Warren Buffett famously counselled, "Be greedy when others are fearful."

Now that's not always easy to do.

And buying stocks in hopes of picking the bottom is no easy feat. It can easily see you buying into a company with much further to fall. Or see you sitting on the sidelines in cash waiting for a stock to fall further only to see it rocket higher before you take the plunge.

However, there are times when companies are beaten down for no reason relating to their long-term outlook.

Like during the pandemic-driven market panic in early 2020.

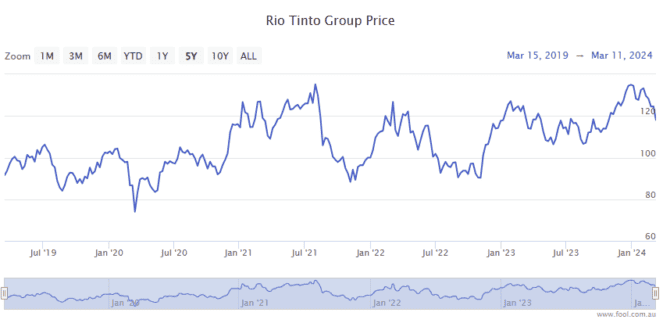

That saw fearful investors send Rio Tinto shares plunging by 23% in less than eight weeks.

However, some greedy investors saw an opportunity on 13 March 2020.

On that day the ASX 200 miner closed trading for $81.08 a share.

That means passive income investors who swallowed their fear and bought on the day will be earning a yield of 8.1% from those Rio Tinto shares.

They'll also have enjoyed a 44% share price gain over that time.