An old investment axiom is that higher the returns, the higher the risk.

And that is largely true.

But there is one neat trick that investors can pull to push up their returns without absorbing additional risk.

How?

Betashares director Patrick Poke spilled the secret on a blog post:

Efficiency = higher returns

Poke describes the trick as "efficiency".

"This means reducing fees and costs. By reducing costs, investors can improve their net returns, without needing to take on additional risk," he said.

"These can be fixed fees like account keeping fees and brokerage fees, or they can be asset-based fees, charged as a percentage of your investment, such as management costs."

There are also the less obvious expenses.

"One often overlooked cost is called 'cash drag'. This is the cost of leaving parts of your money uninvested – i.e. sitting in cash.

"Depending on where those funds are sitting, you could be earning zero interest, a low interest rate, or a savings account interest rate."

This isn't money that you're saving for some tangible purpose, such as to cover living expenses, reduce volatility, or to use to buy bargain shares.

"Cash drag occurs when you have money that you intend to invest but haven't made those investments yet."

Fees and cash drag — some investors might say they make negligible difference.

But just like how the magic of compounding turbocharges your investments over the long term, these costs add up and multiply over time.

Surely the investment returns couldn't be that much higher?

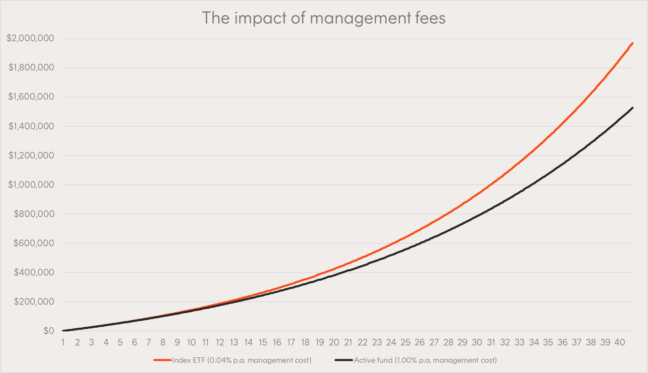

Let's take management fees in exchange-traded funds (ETFs) as an example.

If you have two funds with similar risk and performance, but one charges 1% per annum while the other levies a 0.04% annual fee, the end difference can be astounding.

Poke compared the results after 40 years of investing.

"Assuming the return is the same for both funds, the investor paying the higher fee ends up with $1,526,020, while the investor paying the lower fee ends up with $1,970,010," he said.

"That's $443,990, or 29% more!"

And check out the effect of cash drag.

Poke looked at what happens when an investor adds $1,000 each month to the portfolio compared to if they saved up that cash to invest it all at the end of each year.

"The annual investor ends up with $1,838,577 at the end of year 40, while the monthly investor ends up with $1,970,010.

"Investing monthly resulted in a balance that was $131,433, or 7.1% higher."

So the moral of the story is that a few dollars at the time of transaction may not seem like much, but they can have a significant impact on the performance of your portfolio.

"They can really add up over a long period. And when you account for the compounding of returns, the difference can be significant."