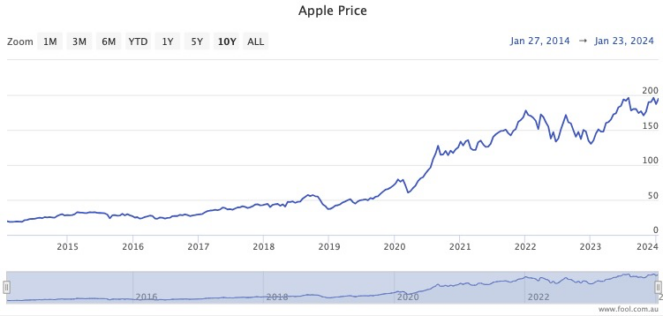

Despite already being a massive company in 2014, Apple Inc (NASDAQ: AAPL) shares have rocketed since then.

The computing giant has impressively come up with new innovations consistently to keep the demand for its products perpetually growing.

Ten years ago, the Apple share price was hovering around the US$18 mark.

If you had the foresight to buy US$20,000 of stock at that price, just 10 years later, it would now be worth US$216,866.

That's better than a 10-bagger in the space of just a decade. A decade in which Apple spent a significant time as the largest company in the world.

Just amazing.

So is there an ASX growth stock that could emulate Apple?

Let's check out Camplify Holdings Ltd (ASX: CHL).

Australia's version of AirBnB?

Camplify is an online platform for owners of recreational vehicles to lend them out to strangers, generating cash when otherwise they would sit unused.

In simple terms it has been described as Airbnb Inc (NASDAQ: ABNB) for RVs.

The company listed on the ASX in June 2021 after an initial public offering (IPO) that saw shares sold at $1.42 each.

Camplify shares are now going for around $2.17.

Why does it have potential to be a multibagger in the coming years?

The business is growing rapidly.

Check out these numbers from the 2023 financial year compared to the year before:

- Revenue up 126%

- Net loss down 66%

- Cash flow per share improved from negative 13.1 cents to positive 4.8 cents

And professional investors are bullish on Camplify.

According to CMC Invest, both Canaccord Genuity and Morgans rate the ASX growth stock as a strong buy.

Can it become a 10-bagger over the next decade though?

Of course, no one can definitively answer that.

But what I can tell you is that over the past 10 years, Apple has never grown its revenue 126% in the space of just one year.

Camplify, at a much earlier stage of its life, has the potential to do anything.