The Rio Tinto Ltd (ASX: RIO) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $127.80. In morning trade on Wednesday, shares are swapping hands for $129.99 apiece, up 1.7%.

For some context, the ASX 200 is up 0.07% at this same time.

Here's what investors are considering today.

ASX 200 miner aims to cut emissions

Atop the 2.6% overnight increase in the iron ore price to US$132.25 per tonne, the Rio Tinto share price could be getting some tailwinds from the announcement that the company will help spur the development of Australia's largest solar power project.

In a 25-year power purchase agreement with European Energy Australia, Rio Tinto will buy all the electricity from the 1.1GW Upper Calliope solar farm, located near Gladstone, Queensland.

The ASX 200 miner said this would enable it to provide renewable energy for its Gladstone operations: the Boyne aluminium smelter, the Yarwun alumina refinery and the Queensland Alumina refinery. Though more renewable sources will be needed to fully power those assets.

According to the release, the Upper Calliope project has the potential to lower Rio Tinto's operating carbon emissions by 1.8 million tonnes per year.

If approved, construction of the Upper Calliope plant is scheduled to commence in 2025 or 2026. The project could provide about 5% of Queensland's current power needs.

Commenting on the agreement that could offer longer-term support for the Rio Tinto share price, CEO Jakob Stausholm said, "This agreement is a first important step in our work to repower our Gladstone operations and illustrates our commitment to keeping sustainably powered industry in Central Queensland."

Stausholm noted that challenges remain on the ASX 200 miner's path to net zero.

According to Stausholm:

Competitive capacity, firming, and transmission are critical to developing a modern energy system that can ensure more large-scale renewables development in Queensland and help guarantee the future of Australian industry.

European Energy CEO Erik Andersen said, "By supplying renewable energy to one of Australia's key industrial hubs, we are setting a new standard for industrial energy consumption."

Rio Tinto share price snapshot

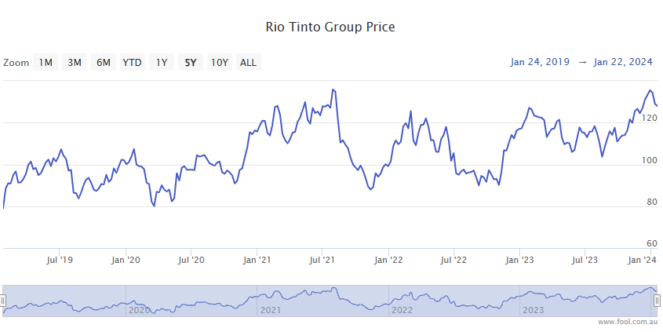

The Rio Tinto share price is up 2% over the past full year and up 12% over six months.