The Northern Star Resources Ltd (ASX: NST) share price is shining bright today.

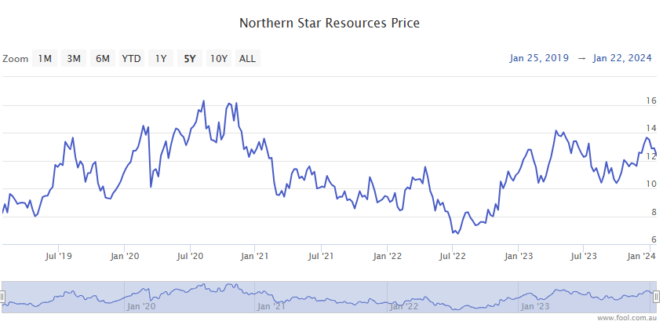

Shares in the S&P/ASX 200 Index (ASX: XJO) gold miner closed yesterday trading for $12.08. As we head into the lunch hour on Wednesday, shares are swapping hands for $12.75 apiece, up 5.6%.

For some context, the ASX 200 is down 0.16% at this same time. And in a better comparison of apples to apples, the S&P/ASX All Ordinaries Gold Index (ASX: XGD) is up 2.7%.

The Northern Star share price is outperforming today following the release of the ASX 200 gold stock's quarterly update for the three months ending 31 December.

Read on for the highlights.

(All figures in Aussie dollars unless otherwise noted.)

Northern Star share price lifts off on strong outlook

Northern Star stock looks to be getting a boost today after the miner reported generating an underlying free cash flow of $102 million.

Over the three months, Northern Star sold a total of 412,000 ounces of gold at an all-in sustaining cost (AISC) of $1,824 per ounce (US$1,186/oz).

The quarter also saw the miner commence mining at its Kalgoorlie Consolidated Gold Mines (KCGM) operations in Golden Pike North ahead of schedule. KCGM is located in Western Australia.

Estimated first-half cash earnings of $685 million to $715 million were well up from the H1 FY 2023 of $467 million.

The Northern Star share price could also be getting a lift, with $131 million of the company's $300 million on-market share buy-back program remaining.

Capital expenditure during the December quarter was $72 million (down from $80 million in the September quarter). Total project capital expenditure year to date is $152 million, in line with expectations.

What did management say?

Commenting on the results sending the Northern Star share price sharply higher today, managing director Stuart Tonkin said:

The value of our diversified production centres was apparent during the December quarter, with an exceptional performance at Kalgoorlie and continuous improvement at Pogo offsetting some operational challenges at Yandal…

Cost pressures remain prevalent across our industry and are a key focus for our teams as we work towards delivering our FY24 guidance, which remains 2H weighted. At the same time, we are making sure our profitable organic growth strategy is executed to plan.

What's ahead for the Northern Star share price?

Looking to what might impact the Northern Star share price in the months ahead, the company's balance sheet remains strong, with net cash of $238 million, and its FY 2024 growth program fully funded.

All told, the miner had $1.1 billion of cash and bullion and $2.6 billion of liquidity as at 31 December.

Management maintained its guidance of 1.6 million to 1.75 million ounces of gold sold at an AISC of $1,730 to $1,790 per ounce in FY 2024.

The miner forecasts its capital expenditure (sustaining, growth, exploration) will be in line with FY 2023, excluding the $525 million capex for its KCGM Mill Expansion.