Westpac Banking Corp (ASX: WBC) shares are in the green today.

The S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $23.45. In morning trade on Tuesday, shares are swapping hands for $23.55 apiece, up 0.4%.

For some context, the ASX 200 is up 0.2% at this same time.

Westpac shares have been off to a strong start in 2024, currently up 2.8% since the closing bell on 29 January. That's a good sight better than the 1.3% year to date loss posted by the ASX 200.

And according to the analysts at Macquarie, Westpac shares look well-placed to outperform their banking peers.

Why did Westpac shares get an upgrade?

Commenting on Macquarie's upgrade of Westpac shares to an 'outperform' rating, analyst Victor German said (quoted by The Australian), "We believe WBC issues are becoming well understood and more appropriately reflected in consensus numbers."

German cited the large downgrades in FY 2023 as reducing the risk to earnings.

He added:

We expect WBC to benefit more than peers from its replicating portfolio, given less of the benefits have been captured to date, offsetting headwinds from deposit mix changes and higher term deposit pricing.

On a normalised basis, German said Westpac shares are now the cheapest among the ASX bank stocks "after incorporating through the cycle impairment changes".

According to German, one of the red flags to keep an eye on in 2024 is Westpac's ongoing and potentially costly franchise issues, which could take some time to resolve.

The bank is also vulnerable to competition which could pressure its margins and see it lose some of its market share.

Still, Macquarie increased its target price by 17% to $24 a share.

That's 2% above the current level. And it doesn't incorporate the two fully franked dividend payments that Westpac will (quite likely) pay out over the coming year.

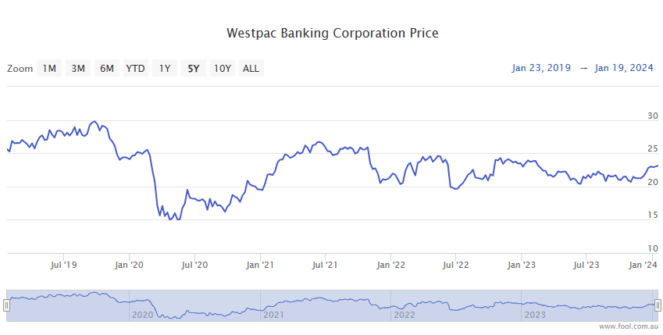

How has the ASX 200 bank performed longer term?

Westpac shares remain down 1.3% over the past 12 months. The ASX 200 bank stock has gained 12.4% over two years.