Have you got $10,000 saved up that you could invest?

If so, you could utilise ASX dividend shares and the magic of compounding to build up a machine that will automatically generate $500 a month without you lifting a finger.

That's six grand of passive income — enough for a nice overseas holiday for the entire family — every 12 months.

How can this be?

It's possible because Australia is blessed with many of the best income-producing stocks in the whole world.

That is no accident. It has come about because of Australia's tax rules, which dictate investors should not be "double taxed".

That is, if a company has already paid corporate tax on its profits then distributes some of that cash to shareholders, it comes with franking. The recipient then does not need to pay income tax on that dividend.

This system provides a major incentive for public listed companies to hand back capital to shareholders using dividends, rather than other methods more popular overseas, such as buybacks.

How to invest $10,000 for passive income

Let's get back to that $10,000 you had.

If we construct a well diversified portfolio full of quality ASX dividend stocks, we can reinvest the distributions each year to grow the pot.

With stocks like Fletcher Building Ltd (ASX: FBU) and Growthpoint Properties Australia Ltd (ASX: GOZ) handing out 8% to 9% dividend yield, there's no reason why you can't achieve 10% CAGR each year with the help of franking and capital growth.

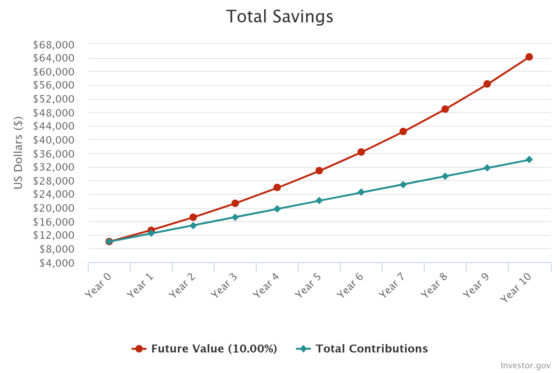

If you can keep saving to buy $200 worth of shares each month, even better.

A quick calculation shows that $10,000 growing at 10% with $200 added each month will become $64,187 after just 10 years.

After that, instead of reinvesting the dividends each year, put it in your pocket.

That'll work out to be about $6,000 annually, which is $500 per month.

Not bad, aye?

If you want an even larger stream of passive income, just keep reinvesting past the 10-year mark.

After 20 years the portfolio will have reached a phenomenal $204,735.

Cashing in 10% of returns each year from that will provide you $20,000 of passive income.

Imagine what you could do with an extra $1,666 of cash each month.

Best wishes for your investments.