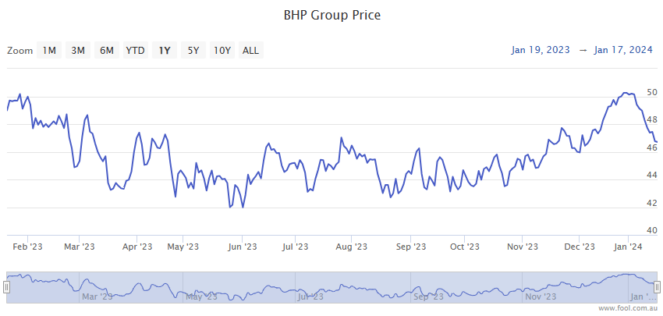

The BHP Group Ltd (ASX: BHP) share price has struggled so far in 2024.

As at Friday's close, shares in the S&P/ASX 200 Index (ASX: XJO) mining giant were down 9.4% since the opening bell sounded on 2 January.

For some context, the ASX 200 is down 2.7% so far in 2024.

Much of the headwinds dragging on the BHP share price have come from a slumping iron ore price, the miner's top revenue earner. The price of copper, BHP's number two revenue earner, is down sharply too.

But it looks to be nickel, which accounts for a much smaller percentage of BHP's revenue, that's putting an extra thorn in the ASX 200 miner's side.

What's happening with the ASX 200 miner's nickel operations?

The BHP share price closed down 1.8% on Thursday following the release of the company's quarterly production update. (The ASX 200 fell 0.6% on the day.)

Investors may not have been overly focused on the miner's nickel operations, yet a 50% year-on-year fall in nickel prices didn't go unnoticed.

"At Nickel West, we are evaluating options to mitigate the impacts of the sharp fall in nickel prices," BHP said.

The miner's quarterly nickel production was up 4% to 40,000 tonnes. But the average realised price of US$18,602 per tonne was down 24%.

According to BHP:

The nickel industry is undergoing a number of structural changes and is at a cyclical low in realised pricing. Nickel West is not immune to these challenges. Operations are being actively optimised, and options are being evaluated to mitigate the impacts of the sharp fall in nickel prices.

BHP said that under the existing market conditions, "a carrying value assessment of the group's nickel assets is ongoing". Investors can expect more details on 20 February with the release of its financial results.

Nickel prices have been under pressure amid a big increase in supply from Indonesia, whose nickel carries a bigger carbon footprint but comes with a cheaper price tag.

Commenting on that situation, Wyloo Metals CEO Luca Giacovazzi said (quoted by The Australian Financial Review):

The industry needs a more appropriate and transparent pricing mechanism, that distinguishes between clean and dirty nickel, so consumers can be confident their EV really is a better choice for the environment.

BHP Nickel West Asset president Jessica Farrell said, "We are working hard to remain globally competitive in a very tough operating environment."

She noted, "Costs have risen sharply and continue to go up while prices have fallen as new supply comes into the market."

BHP share price snapshot

The BHP share price is down 7% over 12 months. Shares are up 3% over the past six months.