The Rio Tinto Ltd (ASX: RIO) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $126.86. In morning trade on Friday, shares are swapping hands for $128.16, up 1%.

For some context, the ASX 200 is up 1.3% at this same time.

The Rio Tinto share price is in the green amid news that the miner is engaged in negotiations with the Serbian government to reboot its derailed $3.7 billion Jadar lithium-borate project, one of the world's largest greenfield lithium projects.

What's happening with the ASX 200 miner in Serbia?

As you may recall, Rio Tinto's Jadar mine faced stiff opposition from environmentalists in late 2021, with protestors taking to the streets to demand a stop to the project's development.

In early 2022, Serbia's government revoked the ASX 200 miner's license for the proposed lithium-borates project. Although at the time, the news did not appear to have a material impact on the Rio Tinto share price.

In late 2021 Rio Tinto had forecast its first production of lithium from Jadar by 2026. The miner estimated Jadar could produce up to 58,000 tonnes of battery-grade lithium carbonate, 2.2 million tonnes of boric acid, and 255,000 tonnes of sodium sulphate annually.

Now, two years later, Rio Tinto CEO Jakob Stausholm has engaged in his first round of discussions with Serbian President Aleksandar Vucic at the World Economic Forum in Davos, Switzerland to get Jadar back on track. A development that could offer some longer-term tailwinds for the Rio Tinto share price.

"It was a very robust conversation with President Vucic and we will look to continue this discussion with the Serbian government around Jadar," Stausholm said (quoted by The Australian Financial Review).

Stausholm said Jadar had the potential to be "a world-class asset", with significant benefits for Serbia.

"Our aim is to help find an outcome that is in Serbia's interests as well as ours," he said.

Vucic called the discussions with Rio Tinto "a difficult conversation, not an easy conversation".

But he added that, "It is important that we listen to them."

Clearly the Serbian government is interested in the investment money that Jadar could deliver for the nation.

"The level of investments in five years would be 20% of the total level of foreign direct investments every year. Just imagine how that would strengthen Serbia," Vucic said.

Stay tuned!

Rio Tinto share price snapshot

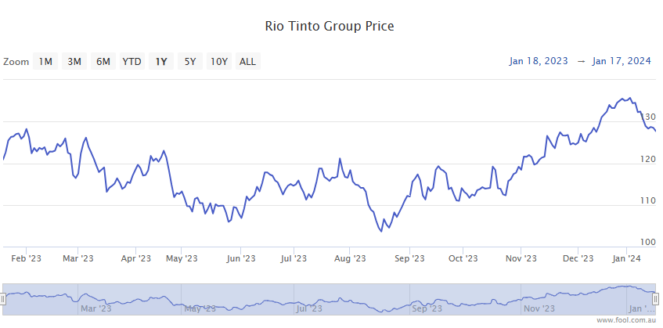

The Rio Tinto share price is up 1% over the past 12 months.

The ASX 200 miner's stock has gained 10% in six months.