Owning Brickworks Limited (ASX: BKW) shares has been a very rewarding experience, particularly for investors focused on dividends.

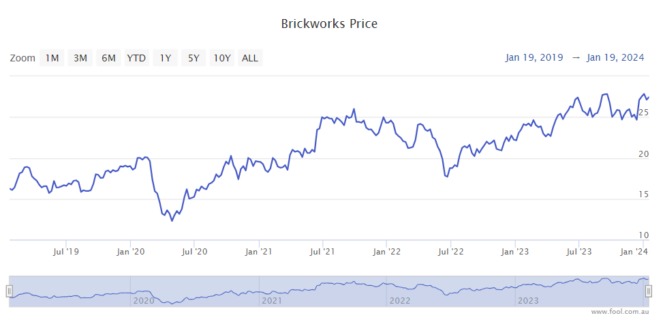

In the past five years, the Brickworks share price has risen by close to 70%, as we can see on the chart below.

I like dividend-paying businesses because it allows us to receive the benefit of profit generation without having to sell our shares. Profit growth can lead to dividend growth, meaning bigger payouts and protection against inflation.

Dividends since COVID-19

I think the last few years have been a good demonstration of any company's dividend and reliability because of how testing the circumstances were.

In the FY20 first-half result, which was released on 26 March 2020, the interim dividend grew by 5% to 20 cents per share. This was announced in the depths of the initial COVID-19 market crash and the rapidly growing number of global deaths.

Then, in the FY20 result, it grew the full-year dividend by 4% to 59 cents per share.

The FY21 first-half result saw Brickworks' interim dividend increase by 5% to 21 cents per share.

In the FY21 result, Brickworks decided to declare an annual dividend per share of 61 cents, an increase of 3%.

The world started returning to normal in FY22, so I'll just mention the full-year numbers from here.

In FY22, Brickworks grew its annual dividend per share to 63 cents, a rise of 3%.

Then, in FY23, the company's annual dividend per share rose by 3% to 65 cents.

That means, between FY20 to FY23, the business paid a total of $2.48 in dividends. That's a cash dividend return of 13% if we use the Brickworks share price from the start of 2020.

It has grown its dividend every year since 2014, which is a great record.

Brickworks share price snapshot

In the past year, the Brickworks share price has risen around 15%.