ANZ Group Holdings Ltd (ASX: ANZ) shares have set a new 52-week high on Friday at $26.12.

The ANZ share price is currently $26.00, up 0.81%, while the S&P/ASX 200 Index (ASX: XJO) is up 0.9%.

There is no official news from ANZ today.

The ASX bank share is currently awaiting the outcome of its appeal against the Australian Competition and Consumer Commission's (ACCC) decision to block its merger with the banking division of Suncorp Group Ltd (ASX: SUN).

ANZ applied for a review of the ACCC's decision by the Australian Competition Tribunal in August 2023.

As reported by Reuters, top broker Citi has put out a note on Suncorp saying the sale of its banking unit is "more likely to occur than not".

Citi says it expects solid revenue growth for Suncorp due to interest rate increases over the past six months.

However, it also expects 1H FY24 net interest margins to be lower than forecasted due to an "intensely competitive environment".

Citi has raised its 12-month share price target on Suncorp shares to $15.55.

The Suncorp share price is currently $14.01, up 0.21% for the day.

ANZ share price snapshot

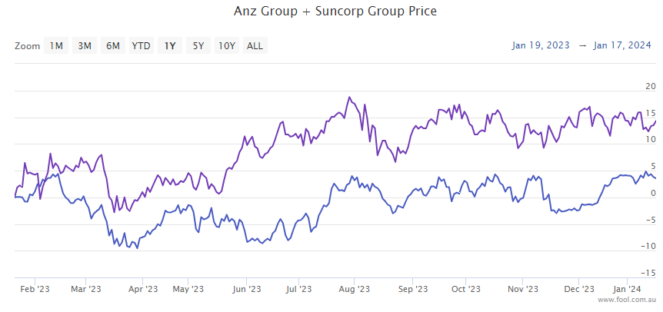

ANZ shares have lifted 4.5% over the past 12 months, while Suncorp shares have risen 13.35%.