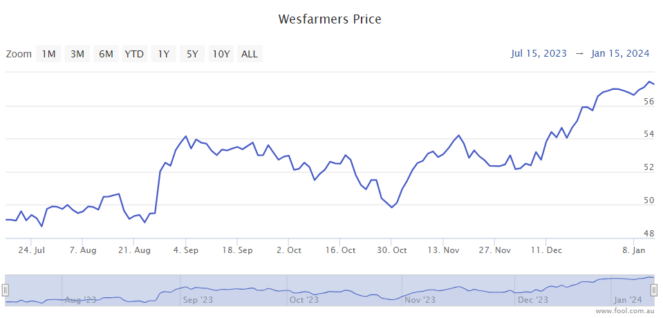

The Wesfarmers Ltd (ASX: WES) share price has done pleasingly well over the last six months. It has surged 17% compared to a rise of around 3% for the S&P/ASX 200 Index (ASX: XJO).

I'd be very surprised if the Wesfarmers outperforms the ASX 200 by another 14% in the next six months. So is the company a good buy today? I'm going to look at that question.

Challenges facing Wesfarmers shares right now

No business is a buy at an infinite price – at some point it becomes overpriced by the market and more likely to go through a correction or even a significant sell-off.

When the (Wesfarmers) share price rises faster than the net profit after tax (NPAT), it increases the trailing and forward price/earnings (P/E) ratio.

Wesfarmers shares are now trading on a higher earnings multiple. According to Commsec, it's now valued at 26x FY24's estimated earnings.

It's not as cheap as it was.

This valuation rise comes at a time when interest rates are at their highest point in Australia in more than a decade. Not only should interest rates hurt valuations (in theory), but they may hinder household spending. Indeed, that's essentially a key aim of the RBA's efforts in raising rates.

Wesfarmers owns many retailers, including Bunnings, Kmart, Target, Officeworks, Catch and Priceline. Interest rates could hurt spending in the coming months, as the full effect of those hikes hasn't been felt yet by many consumers.

The company also expects the profit at Wesfarmers chemicals, energy and fertilisers (WesCEF) to fall significantly.

Pros about Wesfarmers shares

Despite the interest rate rises, households are still spending at Wesfarmers' retailers. Bunnings and Kmart, particularly are doing well because of their product value credentials, according to Wesfarmers. This is good news because Bunnings and Kmart Group are the two biggest profit generators for the business.

While a forward price-to-earnings (P/E) ratio of 26 is quite high for Wesfarmers, I'd suggest there's a good chance profit may accelerate in FY25 and/or FY26 when interest rates start reducing, and households have more room to spend again.

Plus, the company's lithium joint venture with the Mt Holland project should become operational sooner rather than later, which could add another earnings stream (particularly if the lithium price starts recovering).

Wesfarmers (and its underlying businesses) have a long-term track record of delivering profit generation and growth for shareholders. I think this can continue, helped by a projected grossed-up dividend yield of 4.75%, according to Commsec.