In pursuing the best Australian shares, there is one characteristic that I believe matters more than most — longevity. It is the ability to endure that qualifies a company for a long-term investment in my portfolio at a time when the average lifespan of S&P 500 Index (SP: .INX) companies has shrunk from 61 years in 1958 to around 20 years today.

The late Charlie Munger, former vice chair of the US$800 billion Berkshire Hathaway, was full of wisdom. One quote from the extraordinary investor that sticks with me is, "The first rule of compounding: Never interrupt it unnecessarily."

That's why I propose the best Australian shares are those capable of compounding, without interruption, the longest. If possible, then theoretically, there would hardly be a reason to sell. An example is Berkshire Hathaway's 34-year-long holding in Coca-Cola Co (NYSE: KO).

But what about on home soil? Here are two Australian shares I believe are best placed to stay in my portfolio forever.

Pro Medicus shares

What is it?

Pro Medicus Limited (ASX: PME) provides medical imaging software to hospitals, imaging centres and other healthcare groups globally. At its core, the company's software brings medical imaging into the cloud, making large files easily accessible at high speed from anywhere.

Essentially, Pro Medicus is to viewing medical images as Netflix Inc (NASDAQ: NFLX) was to viewing movies. The technology makes an integral part of healthcare a far more convenient experience for its customers.

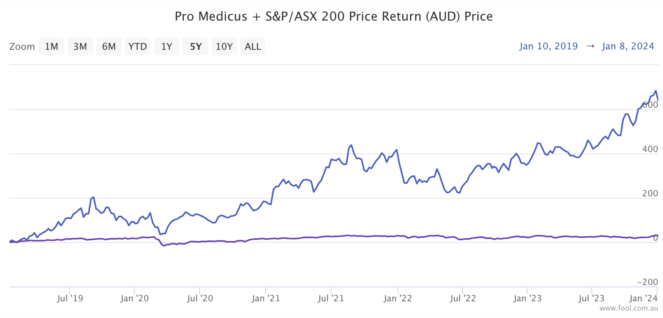

This company has been among the best-performing Australian shares over the last five years, gaining 655% versus the 30.4% return from the S&P/ASX 200 Index (ASX: XJO), as shown below.

Why hold it forever?

Despite Pro Medicus being valued at a price-to-earnings (P/E) ratio of nearly 160 times, I won't sell anytime soon. That might seem ludicrous, but exceptionally high-quality companies can trade at enormous premiums to the market and still represent an opportunity.

To keep it short, the following are three key reasons why I plan to hold this ASX share forever:

- Large and growing market: Medical images are the industry standard for diagnosing many health issues. An aging population and an increasing incidence of cancer globally are possible drivers of the growing adoption of Pro Medicus' technology for decades to come.

- Conscious capital deployers: The company's founders have demonstrated extraordinary capital allocation by virtue of its success since acquiring Visage Imaging. With $121 million in cash, Pro Medicus could be positioned for another transformative acquisition.

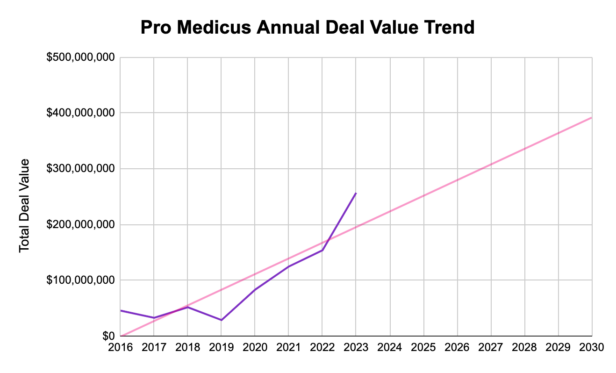

- Growing deal value: As pictured above, the annual dollar value of signed contracts follows a promising trend.

Resmed shares

What is it?

The other company slotting into my two 'best Australian shares' is Resmed CDI (ASX: RMD). It's not an Aussie business by birthplace, but it is listed on the ASX boards, so I'll claim it as such. This 35-year-old company specialises in medical devices used in treating sleep apnea and other respiratory illnesses.

Implementing a razor and blade business model, Resmed sells the device (razor) to its customers before collecting high-margin sales on its face masks and filters (blades), which are recommended to be replaced regularly.

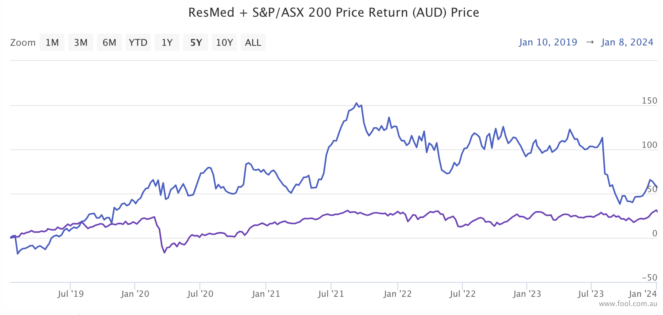

While not as impressive as Pro Medicus, the share price of Resmed has still exceeded the benchmark index by a significant amount over the past five years. As shown below, the medical device maker has returned 67% over five years.

Why hold it forever?

Unlike others, I'm unconvinced miracle drugs such as Ozempic will significantly impact the market for sleep apnea treatment. These medications are not suited to everyone. Additionally, the market size is arguably large enough to sustain high growth even at a reduced size.

In summary, my key reasons to own this share to the very end are:

- Family business: Resmed was founded by Peter Farrell in 1989 but has since handed over the reins to his son, Michael Farrell. The family connection may play a vital role in Farrell ensuring the business' success long into the future.

- Digital expansion: The company is rapidly growing its revenue from software services. This segment may help increase the stickiness of Resmed's offerings to customers.

- Innovation: Research and development runs through the blood of Resmed. Over decades, the company has continually iterated upon its design and launched new products.

Keys to the best Australian shares

I'd scan the share market for companies meeting the following criteria to find evidence of longevity:

- Sustained high net profit margin

- Regular development of new products/technology

- Return on capital employed (ROCE) routinely above 15%

- Low (or no) shareholder dilution

I find these helpful in hunting down what could be the best shares Australia offers.