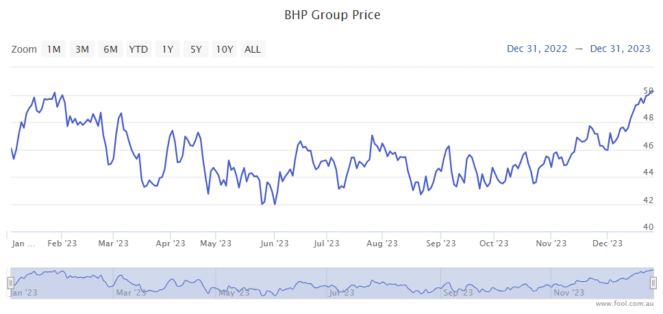

The BHP Group Ltd (ASX: BHP) share price went up by 11% in 2023, beating the S&P/ASX 200 Index (ASX: XJO) which rose by 9%.

BHP is the biggest business in the ASX 200. With a market capitalisation of $257 billion according to the ASX, it has a major influence on the ASX 200.

So let's dig into how BHP managed to beat the ASX 200 Index in 2023.

Commodity prices are key

The ASX mining share generates its earnings from producing vast amounts of resources.

Iron ore is usually the most important factor in BHP's profit each year. It's also involved in copper, coal, nickel and potash.

As the iron ore price changes, it means BHP's profit generation potential goes up and down, which is why the BHP share price can be so volatile.

The profit-making affects the dividend, so the iron ore price is key to a number of areas when it comes to BHP.

In FY23, BHP made total underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of US$28 billion, with iron ore underlying EBITDA of US$16.7 billion – iron ore was responsible for around 60% of underlying EBITDA.

The iron ore price is currently above US$140 per tonne, it was last above this in FY22, more than 18 months ago. The iron ore price climbed around 20% in 2023 thanks to ongoing demand for the commodity, with measures of economic support from the Chinese government, according to Trading Economics.

FY23 saw BHP's attributable net profit decline 58% to US$12.9 billion, with a full-year dividend per share of US$1.70 per share.

Expectations play a part

Investors' views on where profits and dividends are forecast can influence the BHP share price.

As the iron ore price strengthens further, it's increasing how much profit analysts are expecting the company to make.

According to Commsec, BHP is projected to generate earnings per share (EPS) of $4.17 in FY24 and $3.77 in FY25. This could enable the business to pay an annual dividend per share of $2.19 in FY24 and $2.18 in FY25.

If those forecasts are correct, it means the current BHP share price is valued at 12 times FY24's estimated earnings and 13 times FY25's estimated earnings. It could pay a grossed-up dividend yield of 6.2% in FY24 and more than 6.1% in FY25.