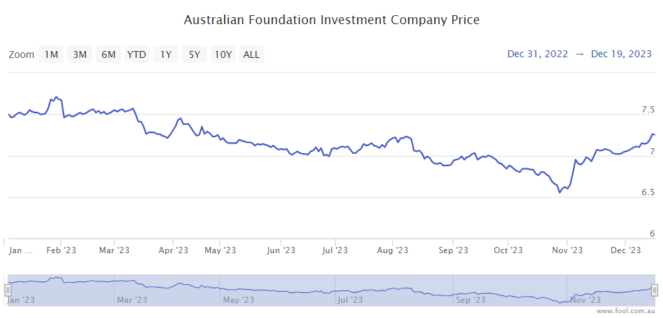

The Australian Foundation Investment Co Ltd (ASX: AFI) (AFIC) share price has disappointed this year. But, it could be priced for solid performance in 2024, according to Bell Potter.

AFIC is one of the oldest and largest listed investment companies (LICs) in Australia – it has been going for around a century.

The job of a LIC is to invest in other shares on behalf of shareholders so they don't have to do all of the research and decisions themselves.

A LIC's portfolio (and other assets/liabilities) is worth an amount of money, which is called the net tangible assets (NTA). Sometimes, the AFIC share price trades above this NTA figure in per-share terms (a premium), and sometimes, the LIC can trade below the NTA (a discount).

The analyst Hayden Nicholson from broker Bell Potter has outlined why it's an attractive idea for 2024.

Positives about AFIC shares

Bell Potter said the LIC has a long-term perspective that emphasises quality investments with a focus on after-tax returns for shareholders.

Nicholson explained that AFIC has a fixed cost base, enabling it to be a highly competitive, low-cost investment vehicle. It has an internal annual cost ratio of 0.14% which is "particularly compelling when juxtaposed to popular low-cost passive exchange-traded funds (ETFs)."

AFIC has generated an annualised post-tax asset return of 7.5% over the last 15 years, and is now "priced at a cyclical low, with the more traditional LICs exhibiting a greater confidence for mean-reversion."

For most of the COVID-19 period, AFIC traded at a premium of more than 5% to its NTA and sometimes the premium was more than 10%. In November it was trading at a discount.

I'd also point out the business has been incredibly consistent with its dividend. Since the GFC it has maintained or grown its annual ordinary dividend each year. At the current AFIC share price, it has a trailing grossed-up dividend yield of 4.9%.

Valuation snapshot

Since the start of 2023, the AFIC share price is down more than 1%, whereas the S&P/ASX 200 Index (ASX: XJO) is up close to 8%.