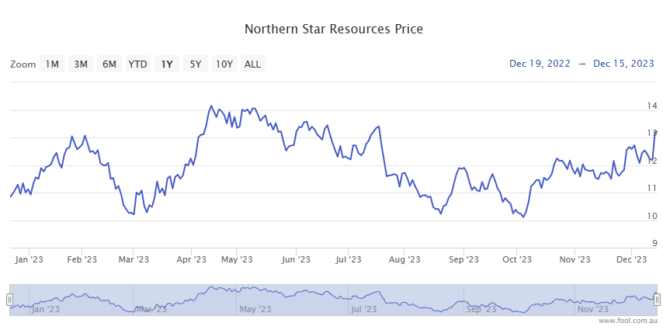

The Northern Star Resources Ltd (ASX: NST) share price has been on a tear over the past 10 weeks.

On 3 October, the S&P/ASX 200 Index (ASX: XJO) gold miner closed the day trading for $10.04 a share. In afternoon trade today, shares are swapping hands for $13.19 apiece.

This puts the Northern Star share price up a whopping 31.3% since 3 October. That's more than four times the 6.9% gains posted by the ASX 200 over this same period, and well ahead of the 20.1% gains posted by the S&P/ASX All Ordinaries Gold Index (ASX: XGD).

Atop those capital gains, Northern Star stock trades on a 2% partly franked dividend yield.

Here's what's been happening, and what we might expect next.

What's been lifting the Northern Star share price?

The biggest catalyst helping lift the Northern Star share price over the past 10-plus weeks has been a fast-rising gold price.

On 3 October, the yellow metal was trading for US$1,823 per ounce. After peaking at new all-time highs of more than US$2,072 per ounce on 1 December, gold is currently trading for US$2,021 per ounce.

That sees bullion up 10.9% over the 10 weeks.

The gold price, and by connection the Northern Star share price, has been supported by ongoing central bank buying, as well as sustained demand for its haven status amid rising geopolitical conflicts.

Gold and the big Aussie gold producers also got a lift last week following the US Federal Reserve meeting. Not only did the Fed opt to keep interest rates on hold for a third consecutive meeting, but the central bank also flagged the potential of multiple rate cuts in 2024.

Gold, which pays no yield itself, tends to do better in an environment of lower or falling rates.

Separately, the Northern Star share price got a boost in late November when the miner released a promising report on recent exploration success across its gold assets.

Managing director, Stuart Tonkin said, "Our team has made excellent exploration progress this financial year to advance operational, growth and discovery projects."

What's next for the ASX 200 gold miner?

With a 31% boost in the Northern Star share price already in the bag the question now is, what can ASX 200 investors expect next?

Well, first we need to be realistic in that the ASX 200 miner isn't likely to see this same massive surge every 10 weeks.

But that doesn't mean 2024 may not be a very profitable year for the company and its shareholders.

Much of that profitability will, of course, be determined by the miner's production levels and its realised gold price, bearing in mind the company's existing hedging commitments.

At its quarterly update, released on 19 October, Northern Star reported total hedging commitments of 1.68 million ounces at an average price of AU$2,929 per ounce. That's a bit below the current Aussie dollar gold price of AU$3,016 per ounce.

For its FY 2024 guidance, Northern Star is forecasting 1.6 million to 1.75 million ounces of gold sold at an all in sustaining cost (AISC) of AU$1,730 to AU$1,790 per ounce.

Comparing those sales estimates and costs to the current gold price, you'll see there are some juicy potential profits ahead, which could boost the Northern Star share price and its upcoming dividends.

As for what to expect from the gold price in 2024, the World Gold Council's primary expectation is for gold prices to remain stable, with the potential for the yellow metal to run even higher from its recent records.

According to Juan Carlos Artigas, global head of research at the WGC:

Taking into account all relevant factors for 2024, including event risk and sustained strong central bank demand, we expect conditions to be in place that support a stable gold market at the least and even a possible surprise to the upside.