The ASX real estate investment trust (REIT) sector might be a compelling place to look for investments before interest rates start falling.

When are interest rates going to fall? It could be some time yet. But plenty of share prices have risen over the past two months in anticipation of rate cuts. A month ago, I suggested some property businesses were opportunities, and pleasingly, their share prices have risen since then.

While some of the easy gains have been made, I still believe that some ASX stocks are at an attractive price today compared to where they might be in two or three years amid a falling interest rate environment. These would be two of the property names I'd put at the top of my buy list.

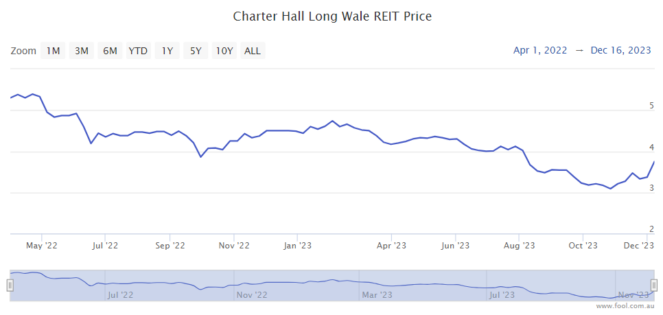

Charter Hall Long WALE REIT (ASX: CLW)

This ASX REIT owns a variety of properties, including logistics properties, BP service stations, office buildings, high-quality retail properties, bus terminals, Bunnings sheds, agri-logistics, telco exchange properties and so on.

What links all of these properties together is the long leases. At the end of September 2023, the weighted average lease expiry (WALE) was 11 years. This gives investors plenty of income visibility for the next decade.

Half of the property portfolio has rental income growth linked to CPI, which is benefiting from strong increases. The other half has a fixed rental increase of 3.1% — still a solid rate.

With a portfolio occupancy rate of 99%, the business is enjoying strong performance on the rental income side of things.

While higher interest rates are a bit of a negative for commercial property valuations (or at least the capitalisation rate) and interest costs, I think the Charter Hall Long WALE REIT share price being down around 30% from April 2022 reflects the financial environment.

Its guidance is a distribution of 26 per security for FY24, which is a distribution yield of 6.8%.

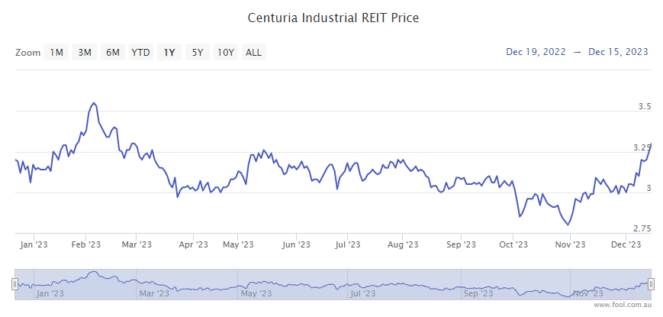

Centuria Industrial REIT (ASX: CIP)

This ASX REIT focuses on industrial properties in cities where there's limited supply, which creates an environment for solid organic rental growth.

In the first quarter of FY24, the business reported "positive re-leasing spreads averaged 48%, up from 37% at 2HY23, reflecting sustained tailwinds across the infill industrial markets".

In other words, in the FY24 first quarter, the business saw the rent at the relevant properties jump 48% compared to the rent it was receiving before. A huge increase!

The property portfolio had an occupancy rate of 98.6% with a WALE of 7.8 years, which also provides good long-term income visibility.

Logistics and industrial properties remain important for businesses, even in a work-from-home and e-commerce world. I'm less excited about office and retail properties.

The business is guiding the FY24 distribution will be 16 cents per security, which is a forward distribution yield of 4.8%.