The Woodside Energy Group Ltd (ASX: WDS) share price is marching higher on Friday.

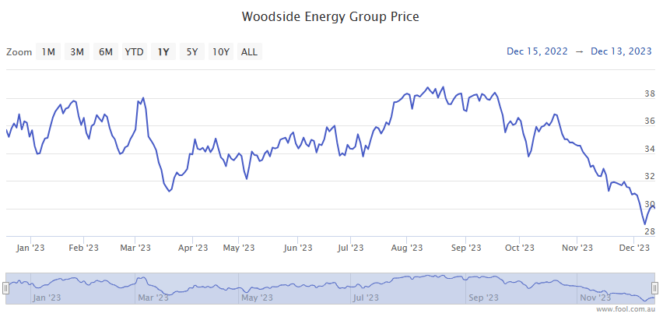

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed yesterday trading for $30.16. At the time of writing, shares are swapping hands for $30.51 apiece, up 1.14%.

The ASX 200 is having another strong run today as well, up 0.9% at this same time.

So, why is the Woodside share price having such a good run today?

What's spurring ASX 200 investor interest on Friday?

It's not just the Woodside share price that's outperforming today.

The Santos Ltd (ASX: STO) share price is up 2.66%, while the Beach Energy Ltd (ASX: BPT) share price is up 3.14%.

This has helped lift the S&P/ASX 200 Energy Index (ASX: XEJ) by 2.07%.

A good part of the tailwinds look to be blowing in from a recovery in the oil price overnight.

Brent crude oil recovered from five-month lows to gain 3.2%, currently trading for US$76.61 per barrel.

The oil price has joined the broader market rally after some surprisingly dovish signals from the US Federal Reserve.

The Fed opted to keep interest rates in the world's top economy on hold Wednesday night, Aussie time. This marked the third consecutive meeting without a rate hike, raising market expectations of one or more rate cuts to come in 2024. And with the US economy and jobs market remaining resilient, so too is the outlook for energy demand.

The oil price, and by connection, the Woodside share price, also looks to have received a lift amid news that US crude stockpiles dropped for the second consecutive week.

What else could be impacting the Woodside share price?

Investors with a longer-term horizon may have taken note of the latest developments surrounding gas at the 28th United Nations climate change conference, or Cop28, in Dubai.

Specifically, the Cop28 pact gives a nod to "transitional fuels" like gas as the world works to slash humanity's carbon emissions.

That global acknowledgement could offer some sustained tailwinds for the Woodside share price.

As the company notes on its website, "The world needs more energy to sustain the basics of life for billions of people. That energy needs to be delivered in new and cleaner ways to reduce emissions and avoid air pollution."

Woodside adds:

Natural gas, which makes up the largest part of our portfolio, can and should play a significant role in extending access to clean and reliable energy while reducing emissions.