The BHP Group Ltd (ASX: BHP) share price is in the red in early trade today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed Friday trading for $47.74. In early trade on Monday, shares are swapping hands for 47.58 apiece, down 0.36%.

For some context, the ASX 200 is up 0.3% at this same time.

This comes amid tailwinds from another uptick in the iron ore price to US$135.20 per tonne and countering headwinds as safety compliance officials at five BHP-owned coal mines in Queensland threaten to go on strike.

Why is the ASX 200 miner facing potential strike action?

The BHP share price is influenced by more than just the company's iron ore operations.

Alongside copper, coal also remains an important revenue earner for the ASX 200 miner.

In Queensland, five BHP coal mines are in the spotlight. Namely, Blackwater, Daunia, Peak Downs, Saraji and Goonyella Riverside.

As The Australian Financial Review reported over the weekend, those mines could be temporarily shuttered, with thousands of workers stood down, if a threatened strike by open-cut coordinators seeking improved enterprise agreements at the mines proceeds.

About 80% of the coordinators – responsible for safety compliance – are voting in a ballot whose options include going on an indefinite strike or no longer performing risk assessments. That ballot closes on 20 December.

Should the coordinators opt to take industrial action, the strikes at BHP's Queensland coal mines could be by 28 December, throwing up some unwanted headwinds for the BHP share price at the end of the calendar year.

Commenting on the ongoing negotiations, Collieries Staff and Officials Association Queensland organiser Zac Gallagher said (quoted by the AFR), "Union representatives have been forced to sit in back-to-back bargaining meetings discussing the same matters and providing the same responses."

He said that BHP wanted to split the safety coordinators into five separate agreements, a position the union opposes.

According to Gallagher:

The workforce has the same employment interests and performs the same roles, the separation of the agreements makes no operational or commercial sense outside of delaying and obstructing collective bargaining.

BHP said it had made "good progress" over the past months in negotiations with the co-ordinators and would "continue to bargain in good faith".

According to a BHP spokesman:

We have been negotiating with bargaining representatives to try to reach agreement on proposed enterprise agreements that fairly reward team members for their service and valued contribution to BMA.

BHP and union representatives are expected to meet again on Wednesday.

BHP share price snapshot

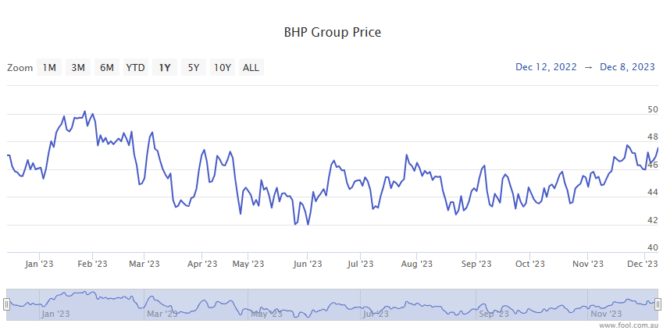

The BHP share price is up almost 5% in 2023.