Core Lithium Ltd (ASX: CXO) shares are enjoying a welcome day of gains today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for 25.5 cents. In early afternoon trade on Friday, shares are swapping hands for 26.7 cents apiece, up 4.7%.

For some context, the ASX 200 is up 0.1% at this same time.

Today's performance is in line with the gains posted by most ASX lithium shares today, apparently buoyed by strong performance among China's top lithium stocks.

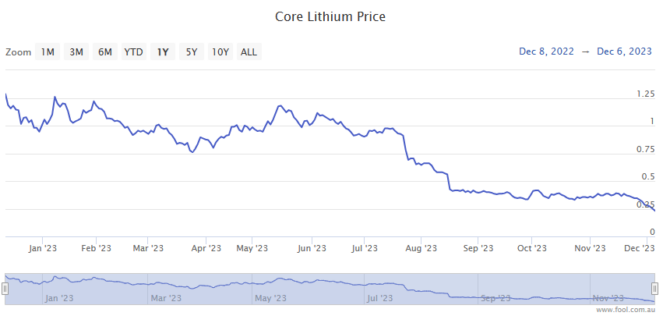

But despite today's boost and a massive 17.4% gain on Wednesday, Core Lithium shares remain down a painful 74% in 2023, as you can see in the chart above.

That's mostly been driven by a free-falling lithium price. The battery critical metal, in sharp retreat since notching record highs in November 2022 amid rising supplies and a temporary easing of demand, is down some 80% since that peak.

And the dour performance of Core Lithium shares continues to attract the interest of short sellers. The stock kicked off this week with a short interest of 11.2%.

But today's turnaround could be a sign of better times ahead.

And it could support the long-term investing strategy espoused by Kylie Parkyn, portfolio manager of the Apostle Funds Management People and Planet Diversified Fund.

The case for holding onto your Core Lithium shares

"One of the most undervalued themes right now is the battery value chain, which includes battery materials such as lithium as well as battery technologies," Parkyn said (courtesy of The Australian Financial Review).

She added that, "This area is primed for substantial growth as the world transitions to a low-carbon economy."

As for Core Lithium shares, which her fund owns and intends to hold onto, she said they were one of "two of the portfolio's critical transition materials holdings [which] saw negative returns through the season".

However, Parkyn noted, "This was in line with the broader clean energy market, which endured a poor month."

So, after a horror year and negative returns through the season, why is Parkyn still optimistic about the outlook for Core Lithium shares?

She explained:

We look beyond market noise and focus on the bigger picture, which is that the world needs to decarbonise, and it needs a lot more lithium than the current global supply to do so. The International Energy Agency and McKinsey forecast lithium demand will grow by 20% to 30% per annum to 2030 in their base-case scenarios.

Citing the "enormity of the global decarbonisation challenge" Parkyn said, "We aim to invest in the winners of that shift, and critical transition materials are one of them."

And she believes Core Lithium shares will count among those winners.