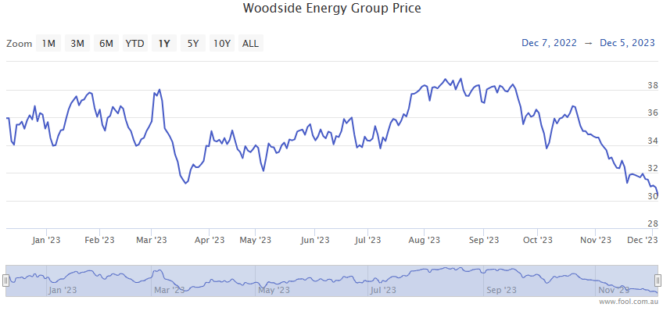

Woodside Energy Group Ltd (ASX: WDS) shares are in retreat today.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed yesterday trading for $29.84. In early afternoon trade on Thursday, shares are swapping hands for $29.16, down 2.3%.

For some context, the ASX 200 is down 0.2% at this same time.

It's not just Woodside shares that are underperforming the benchmark today.

With global oil prices tumbling to five-month lows, the Beach Energy Ltd (ASX: BPT) share price is also down 2.3% while Santos Ltd (ASX: STO) shares are down 2.1%.

With energy stocks struggling today, the S&P/ASX 200 Energy Index (ASX: XEJ) is down 1.9%.

So, what's happening with the oil price?

Woodside shares feeling the heat from a sliding oil price

Despite some bullish medium-term forecasts by leading analysts, the Brent crude oil price slid again overnight to US$74.57 per barrel. That's down some 3.4% since this time yesterday when that same barrel was trading for US$77.20.

It was only back on 27 September that the Brent crude looked set to top US$100 per barrel, trading for US$96.55 on the day. Since then the oil price has fallen 22.8%. That's good news for motorists, but it's seen Woodside shares slide 20.5% over this same period.

The oil price is coming under selling pressure from both the demand and supply side of the equation.

On the supply side, the United States – the world's top producer – continues to pump at record rates and is exporting close to six million barrels per day.

And while OPEC+ has pledged to extend and increase existing production cuts into the first quarter of 2023, the voluntary nature of those pledges has oil traders betting that some member nations will exceed their production caps.

On the demand side, concerns remain about energy demand from China as the world's number two economy continues to struggle to rekindle solid growth.

As for the world's top economy, the US Energy Information Administration (EIA) reported that petrol stocks increased by 5.4 million barrels last week, greatly exceeding consensus expectations.

Commenting on the falling oil price – and by connection the pressure on Woodside shares – Dennis Kissler, senior vice president of trading at BOK Financial said (quoted by Reuters), "There is demand destruction coming in from the fuel side. The market is more demand focused than supply focused right now.

Yet the retrace in the oil price could represent a good entry point to buy Woodside shares, with analysts at Goldman Sachs still forecasting that Brent crude will trade in a range of US$80 to US$100 per barrel in 2024.