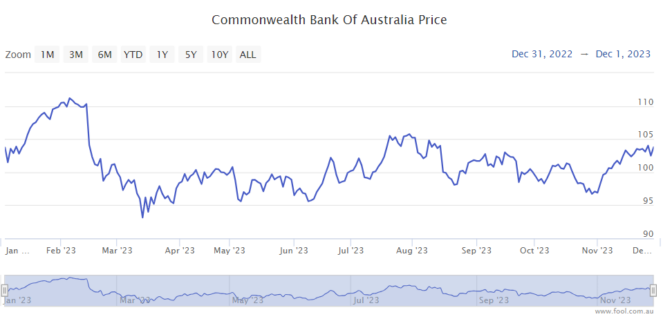

Commonwealth Bank of Australia (ASX: CBA) shares may be on a recovery journey based on the latest loan data. With the CBA share price already up 8% over the past month, could the CBA share price be on course for a new record high?

A bank earns interest income based on two main things – the amount it has lent out to borrowers and what interest rate it is charging on those loans.

Prior to the latest monthly numbers being released, CBA's residential property lending had shrunk in the last few months. CBA wants to make an acceptable profit on its loans for shareholders, but it needs to balance that with maintaining market share. Part of CBA's advantage over competitors is its size.

CBA's residential loan book grows

In the latest monthly numbers from APRA, we learned that the CBA total loan balance to owner-occupiers and investors increased by $63 million.

That's hardly any growth at all in percentage terms considering the CBA home loan book is over $540 billion in size.

But, remember that CBA is the biggest lender when it comes to home loans. Westpac Banking Corp (ASX: WBC) is the next biggest with $457 billion in home loans. If Commonwealth Bank wants to stay the top dog, its loan balance needs to be stable and hopefully grow over the longer term.

We'll have to see if this loan growth has come at the expense of CBA's net interest margin (NIM) or whether other banking competitors have reduced the discounts they're willing to give borrowers.

When the bank announced its latest quarterly update, for the three months to September 2023, it said its NIM had reduced primarily due to "competitive pressure in deposits and customers switching to higher yielding deposits."

For the latest quarter, cash net profit after tax (NPAT) was $2.5 billion, which was flat on the quarterly average of the FY23 second half, and up 1% year over year.

The CBA CEO said:

The Australian economy remains resilient, supported by low unemployment and strong population growth. Higher interest rates are resulting in slowing growth and consumer spending, with pressure on some households and businesses. We remain optimistic on the medium-term outlook. Our balance sheet strength combined with our strong organic capital generation allows us to support our customers through challenging times. Strong banks benefit all Australians, and we remain well positioned to continue to support our customers, invest in our communities and provide strength and stability for the broader Australian economy.

Can the CBA share price reach a new high?

Earlier this year, CBA shares managed to reach just above $111. Getting there would require a rise of more than 6%. That's certainly not an insurmountable target.

The broker UBS pointed out that while CBA is seeing dollar growth in its loan book, it still lost market share because other banks grew faster in percentage terms.

No one can know where share prices are actually going, we can only guess/forecast. A price target is where a broker thinks the share price will be in 12 months from now. UBS has a price target of $105 on the ASX bank share, which implies a slight rise over the next year, but not a new record.

However, if CBA's loan book (and profit) keeps growing then the CBA share price may eventually get to a new high because valuations usually follow profit over time.