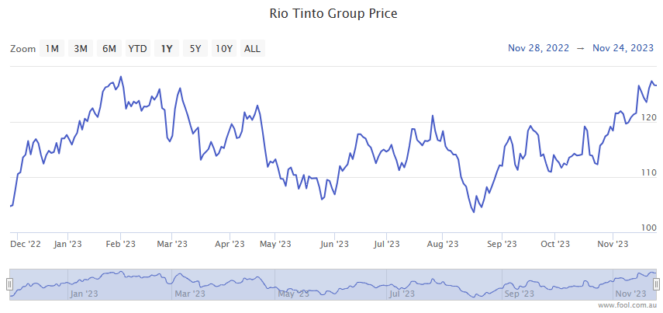

Up 0.3% in intraday trading today to $125.62 a share, the Rio Tinto Ltd (ASX: RIO) share price has soared a whopping 20.6% over the past 12 months.

And that's not including the $5.87 per share in fully franked dividends the S&P/ASX 200 Index (ASX: XJO) iron ore miner has doled out over the year.

If we add those dividends back in, Rio Tinto's accumulated gains work out to 26.3% over the 12 months, with potential tax benefits from those franking credits.

Now, with the new year fast approaching, what can ASX 200 investors expect from the Rio Tinto share price in 2024?

What's the 2024 outlook for the Rio Tinto share price?

One of the biggest factors that will drive, or drag, on Rio Tinto's 2024 revenues and profits is the iron ore price. Iron ore is the company's biggest revenue earner. Copper, bauxite, aluminium and diamonds also count among the metals and stones adding value to the Rio Tinto share price.

As mentioned, the ASX 200 miner's shares have gained 20.6% over 12 months. If you take a look at the iron ore charts, you'll see the industrial metal was trading for US$102 per tonne 12 months ago. Today that same tonne is trading for US$133, up 30%.

Copper prices have increased by some 5% over the full year as well.

With many analysts now expecting the resilient iron ore prices to continue into 2024, I believe the Rio Tinto share price is well positioned for more gains in the new year.

Global steel production (which requires iron ore) has been strong, despite some weakness in China. But the outlook for Chinese steel demand is heating up amid expectations of increased measures from the government to stimulate the nation's sluggish, steel-hungry property markets.

Boosted expectations of Chinese government stimulus recently saw Citi increase its three-month price target for iron ore to US$140 per tonne.

And Goldman Sachs increased its shorter-term iron ore price target to US$130 per tonne while expecting prices to average US$110 per tonne in 2024.

The broker noted that the iron ore price "has continued to outperform vs. expectations in 2023".

Goldman now expects the global seaborne iron ore market to register a 40 million tonne deficit in 2023, having previously forecast a nine million tonne surplus.

This more bullish assessment is "driven by outperforming Chinese steel production underpinned by resilient infrastructure and less drag from property, sustained steel export strength".

Goldman Sachs has a buy rating on the ASX 200 miner, with a $136.10 target for the Rio Tinto share price. That's some 9% above current levels.

What else could influence ASX 200 investors in 2024?

According to consensus forecasts on CommSec, the Rio Tinto share price could get a boost from passive income investors in 2024.

Consensus estimates expect a full-year dividend payout of $6.73 per share. That's up 14% from the past year's payout. And it equates to a forecast yield of 5.4%, fully franked.

The ASX 200 miner is also working to diversify its operations by increasing its exposure to the metals required for the global energy transition.

Following the release of the company's third-quarter results on 17 October, CEO Jakob Stausholm said:

We took real steps to build our portfolio of materials needed for the future, signing agreements that will see us take a leading position in recycled aluminium in North America and agreeing to enter a joint venture with Codelco to explore for copper in Chile.

As for its core revenue earner, the miner reported a 6% year on year increase in its Pilbara iron ore shipments, which reached 83.9 million tonnes over the third quarter.

The Rio Tinto share price closed up 1.2% on the day the company released that update.