One of the best things about owning blue chip ASX shares can be getting pleasing dividend income, particularly when adding in the franking credits.

From my perspective, owning Bendigo and Adelaide Bank Ltd (ASX: BEN) shares may be very rewarding when it comes to passive income.

This company is quite large compared to many other lenders in Australia. It has more than 7,000 employees and around 2.4 million customers. According to the ASX, Bendigo and Adelaide Bank has a market capitalisation of almost $5 billion.

In FY23, the business paid an annual dividend per share of 61 cents which, at the current Bendigo Bank share price, represents a grossed-up dividend yield of 10.1%.

Let's have a look at how good the next two years of dividends could be.

FY24 and FY25 Bendigo Bank dividend projection

The estimate on Commsec suggests that owners of Bendigo Bank shares could get an annual dividend per share of 64 cents in the 2024 financial year. That would be a 4.9% annual increase compared to the payout in FY23.

If the bank pays that projected amount in FY24, it will be a grossed-up dividend yield of 10.6%. This is a huge yield considering where term deposit yields are at present.

The projections on Commsec suggest the estimated dividend per share for the 2025 financial year will stay at the same level as FY24 – 64 cents per share.

As we've already calculated, this level of payout translates into a forward grossed-up dividend yield of 10.6%.

Considering the ASX share market has achieved a long-term average return of between 9% to 10% per annum, being able to get a double-digit return from just dividends could be quite attractive. Remember though – a forecast is not a guarantee of what's going to happen.

The forecast on Commsec suggests the bank could generate earnings per share (EPS) of at least 80 cents in both FY24 and FY25, so it seems quite capable of paying the projected dividends if makes that much profit.

Outlook

At the company's annual general meeting (AGM), the CEO and managing director Marnie Baker said:

Looking ahead, the opportunities for our Bank have never been clearer. Our strengthened focus on delivering sustainable growth and returns is yielding benefits and will continue to do so. Customer preferences are changing, and we need to be responsive. We expect customer interest in our digital mortgage products to continue to grow as customers embrace their convenience and utility, and we will continue to work hard on our transformation agenda and to realise the benefits of further reducing complexity in our operations.

We expect the deposit market to remain very competitive as banks look to build a solid funding base in preparation for the repayment of the Reserve Bank Term Funding Facility. And we see significant latent opportunity in business and agribusiness, particularly given our deep regional roots and community presence.

We successfully delivered on what we promised in financial year 2023 and we are now working towards delivering on our goals for financial year 2024. We will continue to manage our costs diligently and focus on strengthening the returns we derive from our investments, so we can continue to future-proof our business and deliver returns to you, our shareholders.

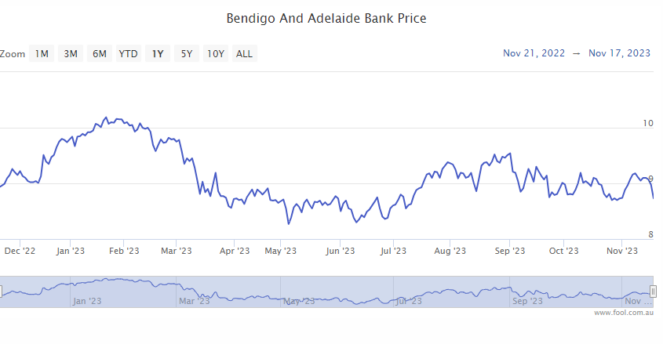

Bendigo Bank share price snapshot

Since the start of 2023, Bendigo Bank shares have fallen by 10%.