The heartening inflation numbers out of the US this week has given investors on both sides of the Pacific plenty of hope that interest rate rises have now finished and bond yields will retreat.

If that situation plays out, we could see a bunch of ASX shares that boom next year.

So here are two stocks that the team at Market Matters likes as a buy heading into Christmas:

'Printing plenty of cash'

Geopolitical and economic anxiety usually results in ASX gold stocks rising, as the precious metal is considered a safe haven.

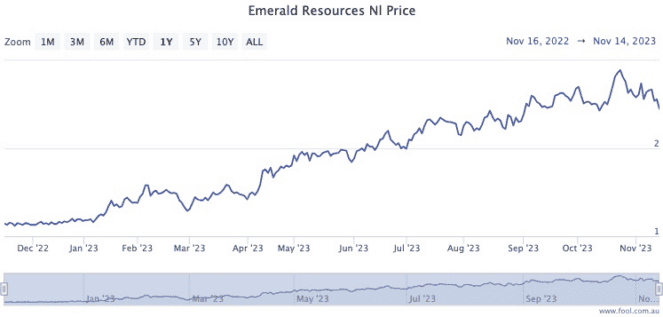

True to form, the Emerald Resources NL (ASX: EMR) share price has more than doubled this year, taking its market capitalisation to $1.74 billion.

Shaw and Partners portfolio manager James Gerrish said his team is bullish for the gold miner into 2024.

"The performance of its Okvau gold mine has given it a huge leg up in 2023," he said to Market Matters subscribers.

"It is printing plenty of cash from the first commercial gold operation in Cambodia, where it produced 28,100oz at an all-in-sustaining cost of US$823 per ounce in the September quarter, making it one of the world's highest-margin gold mines."

According to CMC Markets, both analysts that cover Emerald Resources rate the stock as a buy.

'Bond yield euphoria'

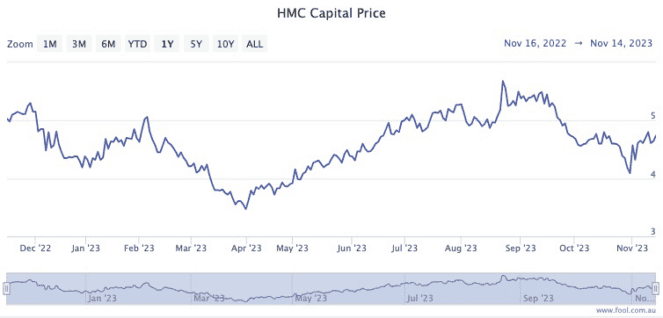

Gerrish described HMC Capital Ltd (ASX: HMC) as "an interesting business".

"[It's] an alternative asset manager that invests in real asset strategies on behalf of individuals, large institutions, and super funds."

In line with its fellow real estate stocks, on Wednesday the HMC Capital share price rocketed 8.7% on the back of "bond yield euphoria".

"Like much of the sector, it's been a tough two years, but we are now looking for, at the minimum, a relief rally after the stock's ~60% decline."

HMC Capital pays out a dividend yield of 2.4%, which is 55% franked.

Other professionals are somewhat divided on the merits of this property stock.

Only three out of nine analysts rate HMC Capital as a buy, CMC Markets currently shows.