S&P/ASX 200 Index (ASX: XJO) stocks are, broadly, enjoying a very strong run today.

Following on subdued inflation readings out of the United States, the benchmark index is up 1.4% in early afternoon trade on Wednesday.

But ASX 200 stock Nufarm Ltd (ASX: NUF) is leaving those gains in the dust.

Shares in the agricultural chemical and seed technology company closed yesterday trading for $4.45. At the time of writing, shares are changing hands for $4.93, up 10.8%.

This comes following the release of Nufarm's FY 2023 results for the 12 months ending 30 September.

Here are the highlights.

What did the ASX 200 stock announce?

The Nufarm share price is leaping higher after the ASX 200 stock reported a 3% year on year increase in statutory net profit after tax (NPAT), which came in at $111 million.

Underlying NPAT decreased by 8% from FY 2022 to $122 million. And revenue was down 3% for the full year to $3.5 billion.

Meanwhile underlying earnings before interest and taxes (EBIT) came in at $250 million, up 6% from last year. While net leverage was 1.9 times as at 30 September, which is within Nufarm's target range of 1.5 to 2 times.

And management declared a final unfranked dividend of 5 cents per share. That brings the full-year payout from the ASX 200 stock to 10 cents per share. At the current Nufarm share price of $4.93, that equates to a yield (part trailing, part pending) of 2%.

Nufarm CEO Greg Hunt noted that FY 2022 was a record year, in terms of comparisons.

"This is a strong result on the back of a record prior period," he said.

Hunt attributed the strong results to "Nufarm's transformed structure and increasing shift to innovative and differentiated solutions".

Indeed, the company reported its Seed Technologies segment delivered double-digit growth.

Hunt also noted the strength of the business in the second half:

Global conditions were more challenging in FY23. Despite these conditions, we grew underlying EBITDA by 4% in the second half of FY23 and experienced only a 2% fall in underlying EBITDA for the full year.

What's next?

Looking at what's ahead for the ASX 200 stock, Hunt said:

Global grain and oil seed stocks-to-use ratios remain tight and grain prices remain attractive, supporting grower plantings and demand for crop protection products. Our balance sheet is strong, and we have a clear growth strategy.

He added that trading is expected to "remain challenging" in the first half of FY 2024 "as the industry adjusts to a lower level of input cost and prices".

Hunt expects Nufarm will return to growth in the second half.

Looking further ahead, he added, "We remain on track to meet our FY 2026 revenue aspirations."

Nufarm share price snapshot

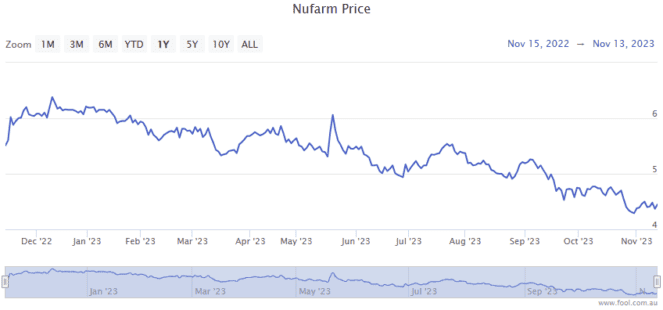

Despite today's big boost, the Nufarm share price remains down 19% in 2023.

The ASX 200 stock is down 9% over the past full year.