It's been a solid day for the S&P/ASX 200 Index (ASX: XJO) and most ASX 200 shares so far this Tuesday. At the time of writing, the ASX 200 has added a healthy 0.77%, which lifts the index to just over 7,000 points. But let's talk about the Fortescue Metals Group Limited (ASX: FMG) share price.

Fortescue shares are doing even better than the broader market today.

At present, the ASX 200 iron ore mining giant has put on a hefty 2.89% up to $24.38 a share. Even more impressive was how high Fortescue got earlier in the trading day. This afternoon saw Fortescue shares hit a high of $24.40 each.

Not only is that a new 52-week high for the miner, but it's also the highest Fortescue has traded at since mid-2021. So we're also seeing a new two-year high today. Break out the champagne, Fortescue investors.

So what's going on with Andrew 'Twiggy' Forrest's company today that has prompted this massive surge to these new highs?

Well, to get this out of the way, it's got nothing to do with any news, developments, or announcements out of Fortescue itself. That is because there are none. In fact, the last ASX announcement from the miner came way back on 26 October.

That was a quarterly production report, which we covered at the time. In fact, as we documented, investors seemed a bit put out by what Fortescue had to say last month anyway.

Iron ore surge lifts Fortescue Metals share price?

However, all is not lost. Looking at the markets today, we do have one major clue to point out. It's not just Fortescue that is having a day to remember. Fellow miners BHP Group Ltd (ASX: BHP) and Rio Tinto Limited (ASX: RIO) are also enjoying some market-crushing rises. Albeit not quite on the same levels as Fortescue's.

At present, BHP shares are up a robust 1.32% at $46 each, while Rio has banked a gain of 1.76% to $122.25 a share.

This tells us that something is happening that is probably sector-wide.

Indeed, it's highly likely that what is happening with the iron ore price is responsible here.

According to Trading Economics, the iron ore price has been on a tear over the past few weeks. Back on 23 October, iron ore was reportedly going for US$114.89 a tonne. But fast forward to today, and that same tonne is fetching US$130.50.

That's a rise of roughly 13.6% in under a month.

Thank our dollar too

Further, the Australian dollar has given up much of the strength we saw earlier in the month as well. Following the Melbourne Cup interest rate rise, the Aussie rose as high as 65 US cents. But today, it's back to buying just 63.68 US cents at present.

Iron ore is traditionally sold in US dollars, as its pricing implies. Thus, if our dollar falls against the greenback, Fortescue can bring home more Australian dollars for each tonne of iron ore it sells. So we have a galloping iron ore price, combined with a falling Australian dollar.

That's a perfect storm for higher iron ore mining share prices across the board. As such, it's likely that Fortescue investors have this potent brew to thank for the stunning gains we have seen with the company today.

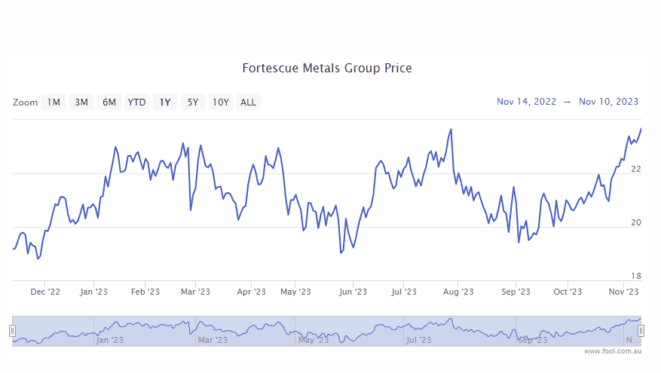

The Fortescue Metals share price is now up a pleasing 19.22% year to date over 2023 so far, and up 24.4% over the past 12 months.