S&P/ASX 200 Index (ASX: XJO) healthcare share Ramsay Health Care Ltd (ASX: RHC) is slipping today.

The healthcare stock closed on Friday trading for $53.93 a share. In early trade on Monday, shares are swapping hands for $53.35, down 1.08%.

For some context, the ASX 200 is down 0.19% at this same time.

This comes following news of a multi-billion-dollar hospital asset sale.

What did the ASX 200 healthcare share announce?

ASX 200 investors are pressuring the healthcare share after the company reported it has reached an agreement – together with its partner Sime Darby Holdings Berhad – to sell its 50:50 joint venture in Asia, Ramsay Sime Darby Health Care.

Columbia Asia Healthcare will pay MYR6.06 billion (approximately AU$2 billion) for hospital assets, representing 100% of the joint venture's enterprise value.

Ramsay said it expects to achieve a net profit after tax (NPAT) for its share of the joint venture of around $630 million. This will be reflected in the company's FY 2024 full-year results through the "discontinued operations line".

Management expects pre-tax (post-transaction cost) proceeds of around $935 million. The ASX 200 healthcare share will use the funds to pay down debt. This is expected to result in annualised interest cost savings of $55 million.

FY 2024 net interest costs (including AASB16 lease costs) are now expected to be at the lower end of Ramsay's previously guided range of $570 million to $600 million.

Commenting on the asset sale, Sime Darby CEO Jeffri Salim Davidson said, "While the hospital business is a great asset … the offer from Columbia Asia was one we could not refuse."

Subject to the receipt of regulatory approval from Australia's Foreign Investment Review Board, the sale is expected to be completed by the end of 3Q FY 2024.

Ramsay Health Care share price snapshot

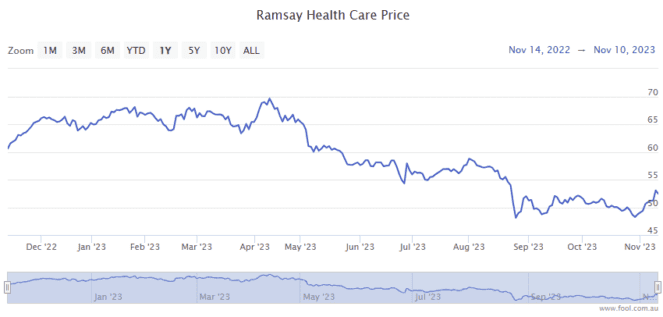

Up 7% over the past month, the ASX 200 healthcare share remains down almost 13% over the past full year.