The ASX utilities sector is finishing the week on a disappointing note, as Origin Energy Ltd (ASX: ORG) shares drag the cohort down today.

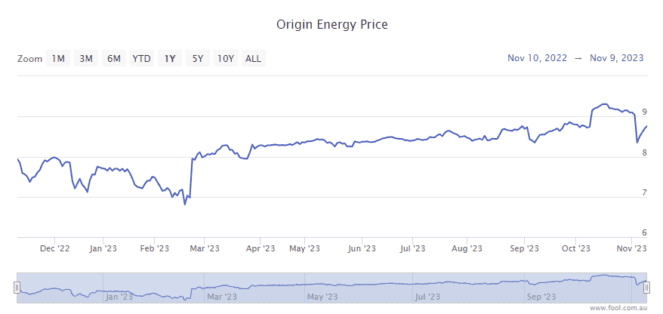

In afternoon trade, the electricity and gas retailer's share price is down 2.5% to $8.65. But, the multi-billion-dollar company's share price is not the attention-grabber.

Instead, the most bemusing characteristic is the number of shares changing hands on Friday.

Voting power up for sale

Since August 2022, a consortium between Brookfield and EIG has been in hot pursuit of Origin Energy.

The standard back-and-forth has ensued, gradually sweetening the proposed takeover bid from the initial $7.95 to the 'best and final' offer of $9.53 per share. This would value Origin at roughly $16.2 billion based on the current number of shares outstanding.

However, AustralianSuper is one shareholder still unconvinced of the proposition. On Thursday last week, the industry super fund manager declared to the market that it intends to rebuff the offer. And, given its 15.05% stake, the super fund could be the determinant force when it goes to a vote.

The company's ownership fate is set to be decided on 23 November. Hence, Origin Energy shares are likely in high demand until then, as they represent more voting power.

Market data shows $662.5 million worth of Origin shares were traded yesterday. Another $444.8 million has traversed the Australian Securities Exchange today. More than 7% of the energy company's market capitalisation has been traded in the last two sessions.

In fact, Origin Energy is the most-traded stock on the ASX on Friday by far. Comparatively, National Australia Bank Ltd (ASX: NAB) ranks second and has turned half as much worth of shares today.

The enormous value of stock being traded raises questions. Some believe AustralianSuper could be increasing its stake beyond its 15% holding. The super fund could acquire a 19.99% stake before requiring a formal bid.

Meanwhile, others speculate that the bidding consortium might be launching an on-market takeover approach. However, neither of these cases has been substantiated at this point in time.

When is the decider for Origin Energy shares?

The D-Day will take shape for Origin Energy shareholders on 23 November, as mentioned earlier.

This is when shareholders formally decide whether to accept or reject the $9.53 takeover bid.

We can already assume which way AustralianSuper will be voting. Three proxy advisors have already announced their support for the bid: CGI Glass Lewis, Institutional Shareholder Services (ISS), and Ownership Matters.

What will be key on the day is how many Origin Energy shares each party holds.