Did someone say cheap S&P/ASX 200 Index (ASX: XJO) passive income stocks?

It's enough to get most investors' attention.

And for good reason.

With a number of leading ASX 200 passive income stocks trading well below where they were over the past few months, there are some quality, high-yielding companies that are looking cheap at current levels.

Buying a dividend stock following a retrace in the share price can potentially see you earn a boosted longer-term yield. Which doesn't mean we're trying to pick the low. That's a mug's game. But we are trying to get in at a price that we believe will be considered cheap over the medium to longer term.

With that said, here are two ASX 200 passive income stocks with trailing yields of more than 9% that look cheap to me today.

Two 'cheap' ASX 200 passive income stocks

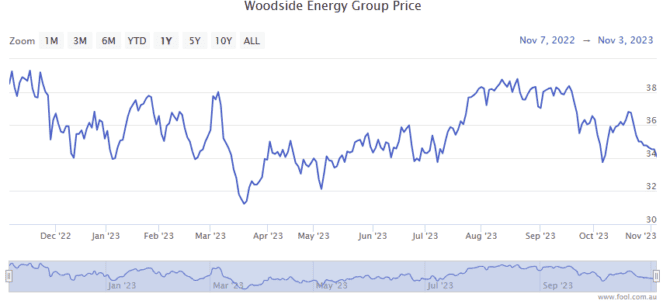

Up first we have Woodside Energy Group Ltd (ASX: WDS).

Shares in the ASX 200 oil and gas stock are down 12% since market close on 15 September, currently trading for $33.91 apiece. That fall has largely been driven by sliding energy prices, with Brent Crude oil dropping from $94 per barrel on 15 September to $85 per barrel today.

But many analysts, myself included, believe the oil price is more likely to rise over the medium term than fall. That's partly due to the conflict raging in the oil-rich Middle East, as well as renewed pledges by Saudi Arabia and Russia to maintain their oil production cuts into the new year.

If energy prices head higher once more, that would make this ASX 200 passive income stock cheap at today's levels.

Looking at the dividends paid out over the past 12 months Woodside shares delivered a final fully franked dividend of $2.154 per share on 5 April. The interim dividend of $1.243 per share was paid on 28 September.

That comes out to $3.40 per share for the full year, for a fully franked trailing yield of 10%.

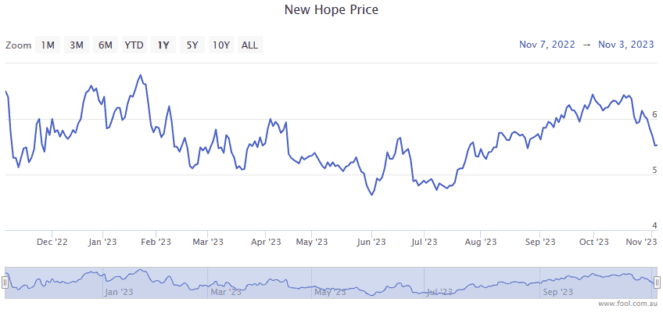

Which brings us to ASX 200 coal stock New Hope Corp Ltd (ASX: NHC).

Like Woodside, this passive income stock has taken a beating recently amid falling coal prices.

Newcastle coal futures prices have dropped 14% since 20 October amid increased coal production in China. That's thrown up headwinds for the New Hope share price, down 19% since 20 October. (The ASX 200 miner also traded ex-dividend on 23 October.)

But as with oil, I believe strong global demand for coal, amid limited new resource exploration and project development, should support prices into 2024. Which could make this ASX 200 passive income stock a potentially cheap buy at the current price of $5.23 a share.

Over the past 12 months, New Hope shares delivered an interim dividend of 40 cents on 3 May. The final dividend of 30 cents per share should be hitting eligible investors' bank accounts today.

That equates to a full-year payout of 70 cents per share. Meaning this passive income stock trades at a fully franked trailing yield of 13.4%.

But if energy prices begin to tick higher once more, neither of these stocks is likely to stay this cheap for long.