Owners of Resmed (ASX: RMD) shares will soon be receiving their quarterly dividend payment, which may offset a little bit of the recent pain for the Resmed share price. Interested investors will need to be quick because the dividend is going to be allocated soon.

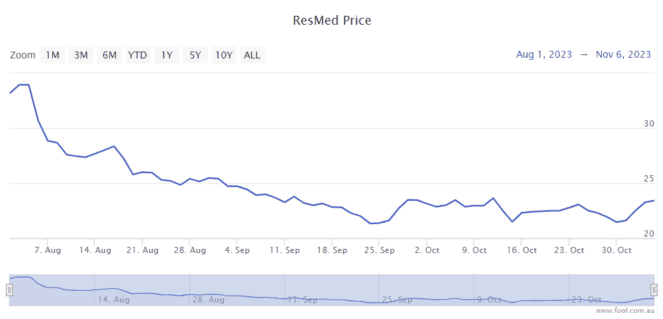

Since early August 2023, the Resmed share price has fallen around 30%, as we can see on the chart below.

How big is the upcoming Resmed dividend?

The ASX healthcare share recently declared a quarterly dividend of US 4.8 cents per share. At the current exchange rate, that would equate to 7.38 Australian cents.

At the current Resmed share price, this payment would represent a dividend yield of 0.31%, so it's certainly not the biggest yield around. However, the yield is bigger after the decline of the valuation following all of the investor worries about what impacts weight loss drugs may have on Resmed's profit in the future.

How quick do investors need to be?

An ex-dividend date is the cutoff date on which investors need to own shares before.

This quarterly Resmed dividend comes with an ex-dividend date of 8 November 2023, which is tomorrow. That means if an investor wants to gain entitlement to this dividend they need to own shares by the end of today's trading.

When will the Resmed dividend be paid?

The ASX healthcare share has told investors that it's going to pay the dividend to investors on 14 December 2023, which is a month and a week away. That's not too long and may help investors boost their returns.

Forecast dividend yield and valuation

According to the estimates on Commsec, the ASX healthcare share is projected to pay an annual dividend per share of 30.6 cents. That would translate into a dividend yield of 1.3%.

It could generate $1.18 of earnings per share (EPS) in FY24, which would mean that it's valued at 20 times FY24's estimated earnings.

It's up to investors to decide whether this sold-down price represents a good price to invest at.