As the horses start their run in the Melbourne Cup on Tuesday, your stock portfolio could be taking a tumble.

That's the implication from economists, who overwhelmingly think the Reserve Bank of Australia will hand down an interest rate rise that afternoon.

According to a survey by comparison site Finder, 69% of economic experts are betting that a rate hike is coming this week.

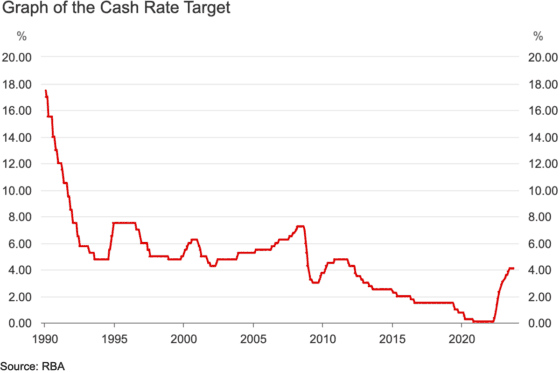

Of those economists who think a rise is coming, all of them reckon it'll be 25 basis points. That'll take the RBA cash rate up to 4.35%.

Inflation just will not die

The worry for the Reserve Bank is the latest consumer price index numbers.

"Inflation is not falling in line with RBA forecasts and after having talked tough on the RBA's preparedness to lift rates if required, the new RBA Governor would look weak if we didn't get a rate hike on the back of the latest numbers," said REA Group Ltd (ASX: REA) director Cameron Kusher.

Impact Economics and Policy economist Dr Angela Jackson agreed a rate rise is coming, but admitted Australian consumers and businesses are hurting.

"Latest data points to the need to slow the economy further to bring down inflation.

"This needs to be weighed against the current per capita recession and the risks of higher unemployment."

AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver reckons the RBA will hike, but his own team's view is that it should hold.

"It's a close call given political pressure [and] the absence of an RBA deputy on the board at present."

Can Aussies cope with another interest rate rise?

Macquarie University economics professor Jeffrey Sheen concurred inflation is not cooling as fast as the authorities would like.

"However, the current pace is consistent with a soft landing, which is surely preferable to the alternative," he said.

"The RBA Board should not raise the cash rate on Melbourne Cup day, and I expect they will not take the risk."

Finder head of consumer research Graham Cooke is worried about whether Australians can handle another rate rise on top of the 12 already dished out over the past 18 months.

"The effects of previous hikes are only starting to take effect, so another rate rise could spell disaster for many homeowners."

Unfortunately, the high September inflation figure has pushed up the chances of another rate rise beyond this week.

As a panel, the experts predict the cash rate will peak at 4.4%.