Westpac Banking Corp (ASX: WBC) shares are leaping higher on Thursday.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $20.74. In morning trade on Thursday, shares are swapping hands for $21.23, up 2.36%.

For some context, the ASX 200 is up 1.14% at this same time.

This comes amid news of a strategic acquisition by the big four bank.

What acquisition did the ASX 200 bank announce?

Westpac shares are marching higher after the bank reported that it has entered into an agreement to acquire HealthPoint.

HealthPoint is an electronic claims processing business that offers real-time private health claiming services to businesses. The system connects healthcare providers, consumers and financial institutions from the point of sale.

Westpac said the acquisition would enable it to expand its payment offerings to support its small business and commercial healthcare customers. Via HealthPoint, customers, including GPs, physios and other specialists, can provide on-the-spot e-health claiming for their patients.

Commenting on the acquisition, Anthony Miller, Westpac chief executive of business & wealth, said: "Healthcare is a vital industry and a strategic focus for Westpac. It contributes around 10% to Australia's economic activity, and this is likely to grow in coming years."

Miller said the bank would integrate HealthPoint's e-claiming solution into its merchant offer "as part of our commitment to better support business customers with their end-to-end banking needs".

Miller added, "We will also invest to build a leading customer experience for private health funds which use e-health claiming."

Westpac said it would establish HealthPoint as a subsidiary. One that will continue to provide services to HealthPoint's existing partners.

The acquisition remains subject to approval by the Australian Competition and Consumer Commission (ACCC) and other conditions precedent.

How have Westpac shares been tracking?

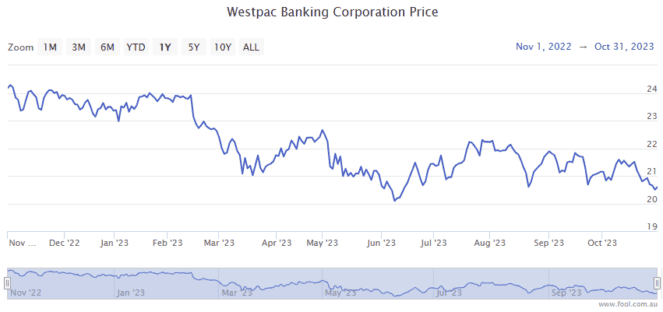

Westpac shares have struggled over the past 12 months, down 13%.