The latest prediction for the iron ore price is in and it could mean a positive outlook for S&P/ASX 200 Index (ASX: XJO) mining shares.

The iron ore price has an extremely important influence on what happens with the profitability of ASX iron ore shares like BHP Group Ltd (ASX: BHP), Rio Tinto Ltd (ASX: RIO), Fortescue Metals Group Ltd (ASX: FMG) and Mineral Resources Ltd (ASX: MIN).

Mining costs don't usually change much month to month, so an increase in the revenue per tonne largely adds to the net profit as well.

Iron ore prediction

According to reporting by The Australian, Citi has increased its three-month iron ore price forecast to US$120 per tonne, up from US$100 per tonne.

Not only that, but the factors are skewed towards the iron ore continuing to rise to potentially US$130 per tonne in a bull case scenario.

Citi analyst Paul McTaggart reportedly said that Chinese officials have increased their efforts to improve the economy with a change to the 2023 fiscal deficit and a plan to issue more central government bonds. The analyst wrote:

China's surprising policy efforts last week, coupled with fresh supply risk from an industry strike in Western Australia, have led to iron ore rallying recently.

These measures haven't completely turned the overall market sentiment, but we remain cautious (positive) about potential incremental supports and Beijing's intention to engineer a strong start to 2024.

We believe iron ore is still the one most exposed (positively) to further policy support compared to other commodities.

The Singapore iron ore futures rose 0.4% to US$122.05 on Tuesday.

This prediction from Citi is much stronger than the latest iron ore prediction from the investment bank Goldman Sachs which was expecting the iron ore price to fall to around US$90 per tonne.

ASX 200 mining share valuations

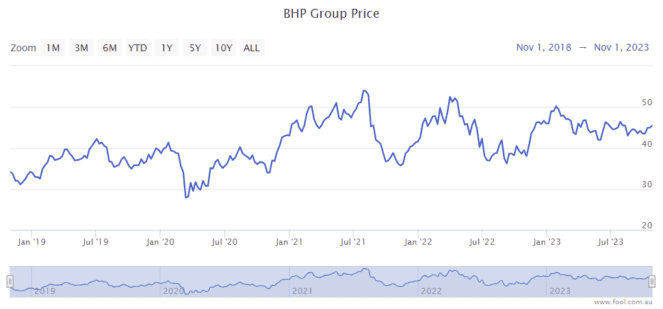

The current calendar year of 2023 has been quite stable for the BHP share price compared to 2022, 2021 and 2020, as we can see on the chart below.

It may be more beneficial for investors to look at ASX 200 mining shares when there's a weakness in the commodity price and the outlook, which isn't the case right now with the iron ore price.

According to the projections on Commssec for the ASX iron ore shares:

The BHP share price is valued at 10.5 times FY24's estimated earnings.

The Rio Tinto share price is valued at 10.6 times FY24's estimated earnings.

The Fortescue share price is valued at less than 9 times FY24's estimated earnings.

The Mineral Resources share price is valued at 26 times FY24's estimated earnings.