The reality of the share market is that quality S&P/ASX 200 Index (ASX: XJO) companies sometimes go for cheap.

That's because stock price is directly set by the supply and demand for the shares. It technically has no link to business performance or outlook.

In other words, emotions can send the share price up or down.

So keeping that in mind, here are two classic ASX 200 shares that experts are urging investors to buy for cheap at the moment:

'Attractive prospect' for 'capital growth and income'

Marcus Today market analyst Matt Lattin thinks one of the giants of the ASX 200 is due for a turnaround.

Biotech CSL Limited (ASX: CSL) made many Australians wealthy over three decades, but it has really struggled since the COVID-19 era, dropping 30.4% since February 2020.

This year especially has been awful, with the share price plunging more than 24% since mid-June.

However, Lattin points out how the company is "committed to delivering double-digit earnings growth in the medium term" via improving margins at the CSL Behring division and increased efficiency from a new plasma donation system.

"CSL's diverse strategy, including the Vifor acquisition, further reinforces its growth potential and reduces risk," Lattin told The Bull.

"In our view, CSL is an attractive prospect for investors seeking capital growth and income."

Indeed CSL has never been famous for its dividend yield, but the discounted share price means it has quietly crept up to 1.55%.

A rare dip for these glamorous ASX 200 shares

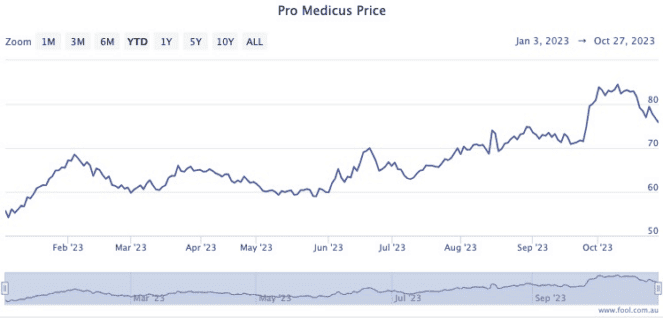

Pro Medicus Limited (ASX: PME) is one of those ASX growth shares that always seems too expensive to buy, but has kept delivering for those brave enough to take the plunge.

Check out these returns: 39.8% year to date and 631% over the past five years.

So when you see that the share price has declined almost 9% this month, it might not seem like the sale of the century but you still need to consider buying the dip.

Baker Young analyst Toby Grimm would, especially with the company signing "the largest not-for-profit health system in Texas" as a new client.

"Shares in this cloud based medical imaging firm recently eased back to attractive levels despite Pro Medicus announcing a $140 million contract over 10 years with Baylor Scott & White Health," he said.

"This contract marks a positive change in contract term, size and client type outside Pro Medicus' traditional deals and underpins near-term earnings forecasts and its longer-term market opportunity."