The BHP Group Ltd (ASX: BHP) share price is in the green.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed yesterday trading for $45.11. In morning trade on Tuesday, shares are changing hands for $45.30 apiece, up 0.4%.

For some context, the ASX 200 is up 0.6% at this same time.

This comes as union officials in Western Australia up the pressure, threatening imminent industrial action.

Here's the latest.

ASX 200 miner aims to sooth labour woes

The BHP share price is one to watch this week as the ASX 200 miner continues discussions with its disgruntled iron ore rail workers and train operators.

Last week the workers overwhelming voted to approve industrial action over ongoing differences relating to salaries and work benefits. Those actions could include work slowdowns or stoppages of up to 24 hours, impacting BHP's mammoth iron ore export facility at Port Hedland, Western Australia.

The current train operators' agreement with BHP stems from 2014. The new agreement has been in the works for two years. But differences remain to be hammered out, according to a ballot lodged with the Fair Work Commission.

Commenting on that ballot and the as-yet unmet demands of BHP's rail workers, Mining & Energy Union (MEU) West Australian secretary Greg Busson said (quoted by The Australian):

The ballot result sends a strong message to BHP that iron ore train drivers have had a gutful and are willing to take strong action for a new agreement that provides some certainty over their working conditions,

In a nod to the BHP share price performance, Busson added, "These drivers make an enormous contribution to the enormous profits BHP generates from iron ore."

BHP reiterated that talks are ongoing, and the company hopes to settle the labour dispute this week yet.

"We will continue to work constructively towards finalising this agreement and will achieve a positive outcome," a BHP spokesman said.

That may mean amending the offer already on the table, which the miner said "fairly rewards" its workers.

According to the spokesman:

There is a process in place with the MEU to finalise the new agreement, with further meetings scheduled this week. This will be the most effective way to conclude our good faith bargaining and finalise the agreement.

Stay tuned!

BHP share price snapshot

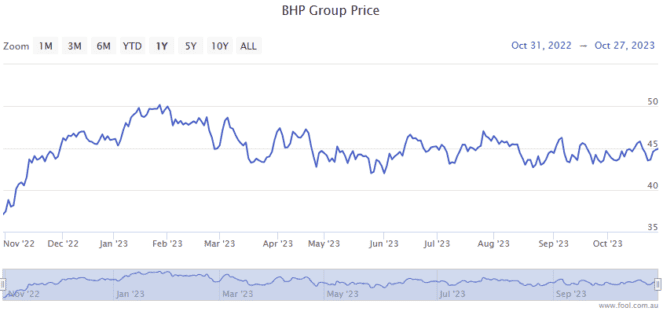

The BHP share price is up more than 21% over the past year.