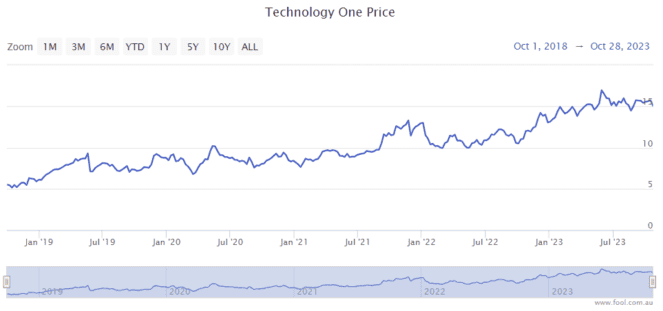

The TechnologyOne Ltd (ASX: TNE) share price has been an impressive performer for investors over the long term.

As we can see in the chart below, the ASX tech share is up 27% in a year and 170% in five years.

There are a number of reasons to like the business, but investors should also keep a couple of factors in mind.

This company provides enterprise resource planning (ERP) software, which is software that helps run the entire business. It offers a global software as a service (SaaS) solution with 1,300 clients across corporations, government agencies, local councils and universities.

Positives about TechnologyOne shares

The company is delivering excellent financial growth year after year, with FY23 shaping up to be another good year.

In the first half of FY23, the company achieved total revenue growth of 22% to $210.3 million, which helped profit before tax and net profit after tax (NPAT) grow by 24% to $52.7 million and $41.3 million, respectively. One of the things I like to see from good businesses is net profit rising at a faster rate than revenue.

The SaaS annual recurring revenue (ARR) jumped 40% in HY23 to $316.3 million. Pleasingly, the company is growing very well in international markets, such as the United Kingdom, where profit rose by 29% to $3 million.

When a business grows at this sort of rate, the strength of the compounding can grow revenue and profit into very large figures after a few years.

The company believes it's on track to surpass its total ARR of at least $500 million by FY26. Management believes that the economies of scale from its global SaaS ERP solution will see its continuing operations profit before tax margin grow to at least 35%.

Shareholders are being rewarded by larger payouts. It has increased its dividend each year since 2014, and in HY23, the dividend per share rose 10%.

I think TechnologyOne's earnings are quite defensive – an organisation can't just stop using software, so its profit could hold up even in a downturn.

Negatives to consider

For me, the main potential downside is the valuation.

According to the earnings estimate on Commsec, the company is projected to generate earnings per share (EPS) of 30.7 cents in FY23. That would put the TechnologyOne share price at 48x FY23's estimated earnings. That's quite pricey, considering interest rates are as high as they've been for a long time, which is meant to bring down asset valuations.

The question is – what's a fair price for a business that's growing strongly?

In FY24, the company's EPS is projected to grow another 17.6% and then another 16% in FY25 to reach 41.9 cents per share. If it gets to that profitability level by FY25, that would mean it's valued at 36x FY25's estimated earnings.

It's always possible that a competitor could develop a superior product, so investors should keep that in mind before being certain strong profit growth will continue forever.

Foolish takeaway

I think we can justify a long-term buy for TechnologyOne shares at the current level, but with the amount of success that's priced in, I wouldn't be surprised to see some volatility over the next year or two.