The Qantas Airways Ltd (ASX: QAN) share price is outpacing the steep losses posted by the S&P/ASX 200 Index (ASX: XJO) today.

Shares in the ASX 200 airline stock closed on Friday trading for $4.76. In morning trade on Monday, shares are swapping hands for $4.75 apiece.

While that means the Qantas share price is down 0.2%, it's still significantly better than the 1.0% loss posted by the ASX 200 at this same time.

This comes as Qantas' management hits back at claims made by the Australian Competition and Consumer Commission (ACCC) in August.

ASX 200 airline addresses turbulence

The Qantas share price is outperforming the benchmark after the company acknowledged it had let its customers down during the turbulent post-COVID restart period. Those restart issues included high cancellation rates, flight delays, and baggage handling problems.

Qantas said staff shortages and supply chain issues hampered its operations just as a huge pent-up demand for travel erupted as borders reopened.

"While we restarted safely, we got many other things wrong, and for that, we have sincerely apologised," the company stated.

However, management hit back at the ACCC, saying the corporate watchdog's case "ignores the realities of the aviation industry". Namely that airlines are not able to guarantee specific flight times.

Responding to the cancellations mentioned by the ACCC, which may have been pressuring the Qantas share price over the past month, the airline said that 100% of impacted domestic passengers were offered same-day flights, either before or within an hour of their original flight time.

For international passengers impacted by cancellations, 98% were offered re-accommodation options on flights within a day of their scheduled departure date.

Management also noted that most passengers were informed weeks or even months ahead of time of the flight change, which enabled them to plan accordingly.

Qantas has received some particularly negative coverage over cancelled flights that were left on sale for longer than 48 hours.

In response, management said:

We acknowledge there were delays and we sincerely regret that this occurred, but crucially, it does not equate to Qantas obtaining a 'fee for no service' because customers were re-accommodated on other flights as close as possible to their original time or offered a full refund.

Management added that cancelled flights are now taken off sale immediately, "well inside the 48 hours that the ACCC case flags".

The airline said that since this was a manual process, it wouldn't have been possible during the tumultuous COVID restart period. Qantas is currently developing a tailored IT solution to automate this process.

Qantas share price snapshot

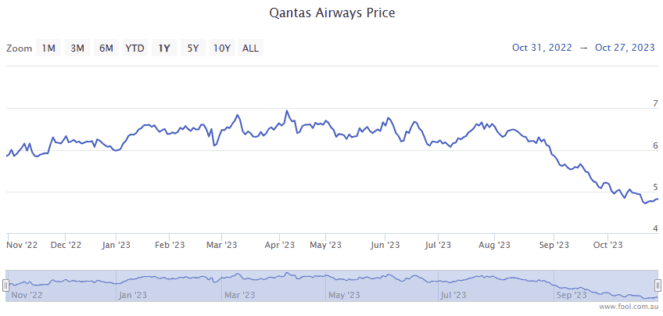

The Qantas share price came under heavy selling pressure in August, leaving the ASX 200 airline stock down 20% year to date.