When a quality dividend stock with structural tailwinds supporting its future drops, you need to at least consider it for your portfolio.

That's because buying at a significant dip not only allows for better capital returns, but boosts the dividend yield regularly lining your pockets for as long as you hold it.

One great example of such an investment at the moment is Pilbara Minerals Ltd (ASX: PLS).

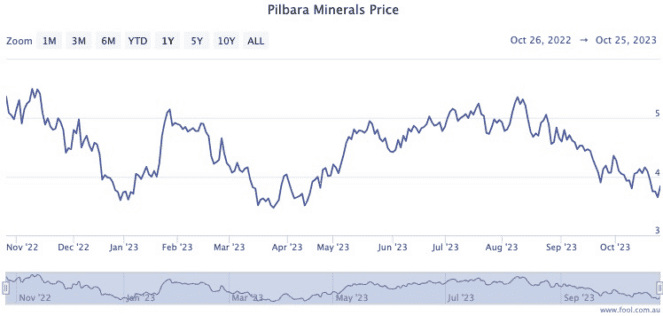

The lithium stock has plunged more than 28% since 10 August. It hasn't been any easier for longer-term shareholders either, who have lost almost 30% from a peak last November.

Why are Pilbara and other lithium stocks down?

Pilbara Minerals is caught up in a downward spiral along with its lithium peers because of weak global demand.

Over the course of the past 12 months, the lithium carbonate price fell from almost 600,000 CNY per tonne to now trade around 165,500 CNY.

That's a 72% drop, which actually makes the dip in lithium stocks look much less punishing.

The demand and price for the mineral have plunged because of a western world weighed down by steep rise in interest rates and a struggling Chinese economy battling deflation.

Why is Pilbara Minerals a buy?

However, more than one expert reckons Pilbara Minerals makes for an excellent investment, especially at the current discount.

"Pilbara is trading on an undemanding price-earnings (P/E) ratio," Medallion Financial Group director Philippe Bui told The Bull last week.

"The company aims to produce a million tonnes by the end of 2025, a significant increase on existing production."

The discounted share price also means the dividend yield is all of a sudden at an outstanding 6.5%, fully franked.

That means each year, you could receive $6,500 of passive income for $100,000 of Pilbara shares held.

The reality is that the world's thirst for lithium will only increase in the long run because of the transition to the next zero.

Lowering emissions means battery products like electric cars rising to take over fossil fuel engines.

And all those high-powered batteries require lithium.

Although short-term price targets have been reduced by multiple brokers in recent weeks, Pilbara remains a buy for nine out 18 analysts currently surveyed on CMC Markets.

Bui is confident Pilbara will head upwards again once the global lithium price recovers.

"The lithium company had $3.3 billion of cash on its balance sheet when announcing its full-year results," he said.

"Provided lithium prices settle in what has been a recent downturn, Pilbara should be able to deliver."

Despite the recent fall in valuation, Pilbara Minerals shares have gained a whopping 388% over the past five years.