Three directors of ASX 200 coal stock Whitehaven Ltd (ASX: WHC) loaded up on extra shares in the two days after the miner announced a proposed $5 billion acquisition of two coal mines in Queensland.

As we reported last Wednesday, Whitehaven wants to buy the Daunia and Blackwater metallurgical coal mines owned by BHP Group Ltd (ASX: BHP) and Mitsubishi Alliance (BMA).

Whitehaven shares surged as high as 15% on the day of the news, with management telling the market it expected the deal to be "materially earnings accretive" for the company.

On Thursday and Friday, three directors of Whitehaven bought more shares. This contrasted starkly with one major investor who offloaded $157 million worth of Whitehaven stock the day after the news broke.

The ASX 200 coal stock is currently trading at $7.74 apiece, up 1.9% so far on Wednesday.

Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is down 0.05% amid surprisingly strong inflation data released today.

Let's take a look at which insiders bought shares last week.

3 insiders buy ASX 200 coal stock after acquisition news

Whitehaven chair and non-executive director Mark Vaile AO spent $49,599 buying 6,650 extra shares on-market last Thursday. The buy-up took his Whitehaven holdings to just under 1.32 million shares.

Anthony Mason bought 6,000 shares on-market on Thursday for a total of $44,684. He did not hold shares prior to the transaction.

Mason is a new board member who joined Whitehaven as a non-executive director in August.

Non-executive director Wallis Graham also bought more of the ASX 200 coal stock last Friday.

She spent $36,400 buying 5,000 shares on-market, lifting her holdings by more than 40%.

Whitehaven shares review

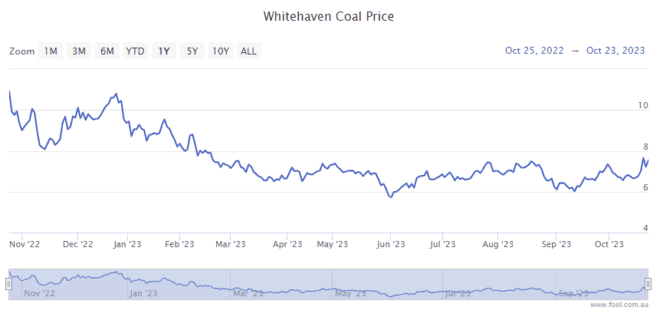

The Whitehaven share price has fallen 25% over the past 12 months. That's not bad when you consider the coal price has plunged 65% over the same period.

The coal price reached an extraordinary record high of above US$430 per tonne in September 2022.

The ASX 200 coal stock went with it, reaching an all-time record high of $11 per share in October 2022.

Today, the commodity is fetching US$136.50 per tonne.