Last week, I explained the importance of evaluating the decision-makers inside a company before investing. The punchline: your ASX shares generally reflect the choices made by the people leading the business — for better or worse.

When someone buys shares in a company, they are entrusting their hard-earned dollars to the management team.

Akin to hiring an employee, you want the best person for the job. Someone with drive, smarts, and integrity. If you can find such a person/people, the good results are often merely a matter of time.

Here are a few people who I believe embody exceptional leadership.

ASX shares helmed by great leaders

When judging the quality of management, I approach it as if they had applied for a job. Unfortunately, like most, I won't be able to speak with management directly. Luckily, we live in the era of the internet, which provides plenty of information — interviews, performance records (return on capital), etc.

Pro Medicus Limited (ASX: PME) is the first management team I've long been impressed by. This imaging software company is led by co-founders Sam Hupert and Anthony Hall. Their nearly 41 years of tenure and 25% equity stake (each) speak to this duo's commitment to their creation.

The pair have demonstrated extraordinary capital allocation, acquiring Visage Imaging for around $5 million in the depths of the global financial crisis. Visage marked a pivotal moment in Pro Medicus' history as the cornerstone of its now best-in-class medical image streaming technology.

Furthermore, Malte Westerhoff and Detlev Stalling — the co-founders of Visage Imaging — are still heavily involved in the company. I consider this a major positive for future succession, as both will arguably care about the company more than an external hire.

Secondly, Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) is another ASX share I'd buy based on its people. The company is still fundamentally a family-operated business even after 120 years.

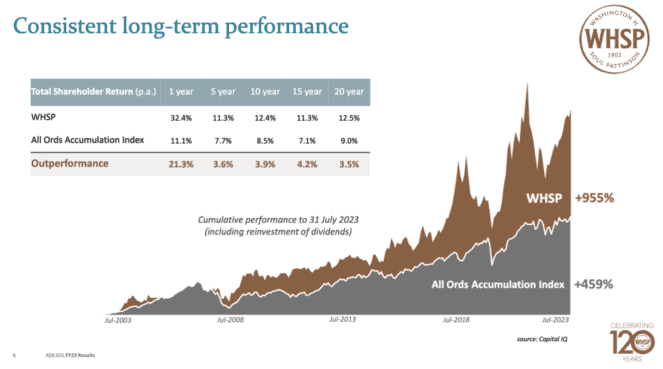

Soul Patts' chair, Robert Millner, is the great-grandson of the company's founder, Lewy Pattinson. Legacy can go a long way in motivating people to succeed. Indeed, Soul Patts has thrived under Robert Millner's guidance, delivering a total shareholder return of 12.5% per annum over the past 20 years.

Moreover, CEO Todd Barlow and the team have displayed patience, sound temperament, and impressive capital allocation over the years. In many ways, the investing mindset demonstrated by Barlow and his team is comparable to Warren Buffett and Charlie Munger of Berkshire Hathaway Inc (NYSE:BRK.A (NYSE: BRK).

Visionary management abroad

Outside of ASX shares, there are other companies I'm personally invested in due to the capable people in charge.

You might have heard of a little company called Meta Platforms Inc (NASDAQ: META)… the owner of Facebook, Instagram, WhatsApp, and Oculus. Founded in 2004, Mark Zuckerberg has been steering this ship for nearly 20 years.

Personally, I don't believe Zuckerberg gets enough credit for his leadership. You only need to watch a few minutes of his interview with Lex Fridman to understand Mark's immense passion for his work. It's clear he is driven by impactful, long-term aspirations.

In addition, Zuckerberg has continually worked to overcome competitive threats. When Snapchat introduced 'Stories', Facebook quickly replicated the feature. When TikTok's short-form videos grabbed attention, Instagram released Reels.

That's the person I want to work on my behalf. Not someone who retreats at the first sign of a hurdle but one who takes up the challenge and innovates accordingly.