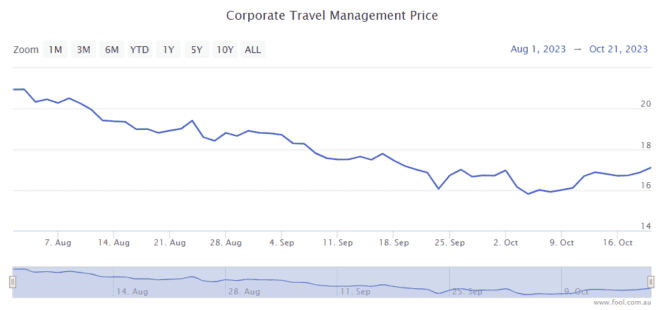

The Corporate Travel Management Ltd (ASX: CTD) share price has dropped 20% since the start of August, as we can see in the chart below. The ASX travel share's ongoing progress makes me think this pullback is an investment opportunity.

This company provides travel services to businesses, and has become one of the five largest travel management companies in the world.

Strong growth

Corporate Travel's latest update for the first three months of FY24 is very promising. It showed 36% revenue and other income growth to $187.9 million, with underlying earnings before interest, tax, depreciation and amortisation (EBITDA) growth of 157.3% to $56.6 million.

The fact that the EBITDA margin improved from 15.9% to 30.1% is pleasing to see. It shows the business is very scalable as revenue recovers to pre-COVID levels (and beyond).

Its large client activity in North America, Australia, New Zealand and the EU is "gradually improving", with this segment being described as a "recovery laggard". That implies there's more room for short-term recovery growth in this segment.

Another positive for Corporate Travel Management shares is its new client wins of $0.35 billion, including verbal wins, in the first quarter of FY24.

The company also revealed that automation and AI projects were "well underway" and expected to have a "positive productivity impact" for many years.

The company also noted that the global travel market was estimated to grow at 7.9% per annum between FY23 to FY26, which is a useful tailwind for earnings.

Management is targeting a "mid-teen double-digit" compound annual growth rate (CAGR) in earnings per share (EPS) terms beyond FY25. FY24 is expected to be a record EPS year, according to the ASX travel share.

Better valuation

When a business is growing profit, a fall in its share price results in a more attractive price/earnings (P/E) ratio.

According to the projection on Commsec, Corporate Travel is forecast to generate $1.05 of EPS in FY24. If it delivers on that prediction, it would mean a forward P/E ratio of less than 16. This seems very reasonable to me, considering there could be more good growth in FY25 and beyond.

It could pay an annual dividend per share of 50 cents, which would translate into a dividend yield of 3% — a useful bonus.