There is never a quiet week in the world, but with all the horror happening in the Middle East it feels like chaos is especially reigning right now.

Helpfully, eToro market analyst Josh Gilbert has summarised the three most critical developments to focus on for ASX shares this week:

1. Australian quarterly inflation

The inflation figures for the third quarter will be released on Wednesday.

The quarterlies seem to carry more weight than the monthly updates, so this will have a huge bearing on what the Reserve Bank of Australia does with interest rates on Melbourne Cup day.

Gilbert noted that the market interpreted the October board meeting minutes as hawkish, so has priced in at least one more hike.

"Q3's CPI reading is forecast to be 5.1%, a drop from 6% last quarter," he said.

"There are some fears over the jump in fuel prices due to global turmoil impacting the RBA's reading – a valid concern."

If inflation sneaks under the 5% mark, that could allow everyone to breathe easier.

"Anything under 5% could be the magic number for the RBA and would be a number that may justify keeping rates on hold in November."

2. US big tech results

Three US shares that have a huge influence on not just American markets but here as well are delivering their latest results this week.

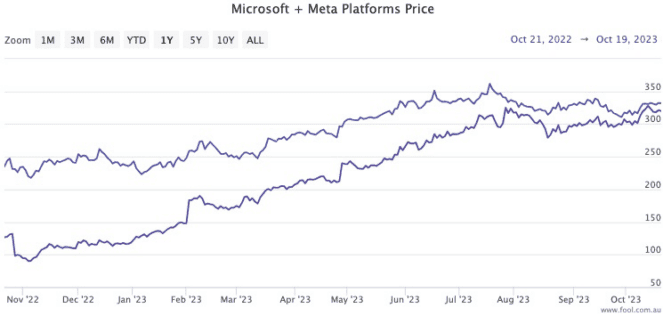

Microsoft Corp (NASDAQ: MSFT), Alphabet Inc (NASDAQ: GOOGL) and Meta Platforms Inc (NASDAQ: META) stocks are also directly owned by many Australians, so the world will be watching with bated breath.

After a 27% rise this year for the Nasdaq Composite (NASDAQ: .IXIC), Gilbert reckons it's crucial that these results don't fall short of expectations.

"Valuations are high, and the expectation from investors will be that earnings are recovering and margins are improving for the tech world's heaviest hitters."

While artificial intelligence has been the hot topic in 2023, there is pressure on the tech giants to get a financial return from the concept.

"Investors will want to hear from management that AI hype can translate into growing revenue and earnings."

3. US GDP

Despite the efforts from the US Federal Reserve to reduce inflation, the world's biggest economy has been surprisingly resilient this year.

Last week, retail sales again rose, frustrating the central bank.

Thursday's GDP growth reading will indicate whether the US is finally slowing down sufficiently without breaking.

"Despite difficult conditions, the US economy is frankly still some distance from a recession, with the Q3 GDP reading set to see growth of 4.1%, the fastest quarterly growth since the end of 2021," said Gilbert.

"A US recession would have global ramifications, so strong growth for the world's largest economy is good news."

He added that US consumer spending continues to be powered along by "a tight labour market" that saw 336,000 jobs created last month.

"However, headwinds are mounting for consumers, many of whom rely on debt to fund purchases.

"Higher borrowing costs as the U.S. central bank tackles inflation have also pushed credit card delinquencies to an 11-year high. These conditions are serious enough to be a concern before the end of the year, but aren't likely to be reflected in next week's data."